For the 24 hours to 23:00 GMT, the GBP declined 6.65% against the USD and closed at 1.2162.

On the data front, UK’s retail sales unexpectedly dropped 0.3% on a monthly basis in February, amid weak sales due to the coronavirus outbreak and compared to a revised rise of 1.1% in the previous month.

The Bank of England (BoE), in its interest rate decision, kept its benchmark interest rate unchanged at 0.1% and maintained the quantitative easing at GBP645bn. However, the central bank stated that it was ready to act again, if needed.

The BoE, in its monetary policy meeting minutes, indicated that there is a risk of longer-term damage to the economy, especially if there are business failures on a large scale or significant increases in unemployment. Additionally, members warned of a sharp reduction in economic as economic consequences of these developments are becoming more visible.

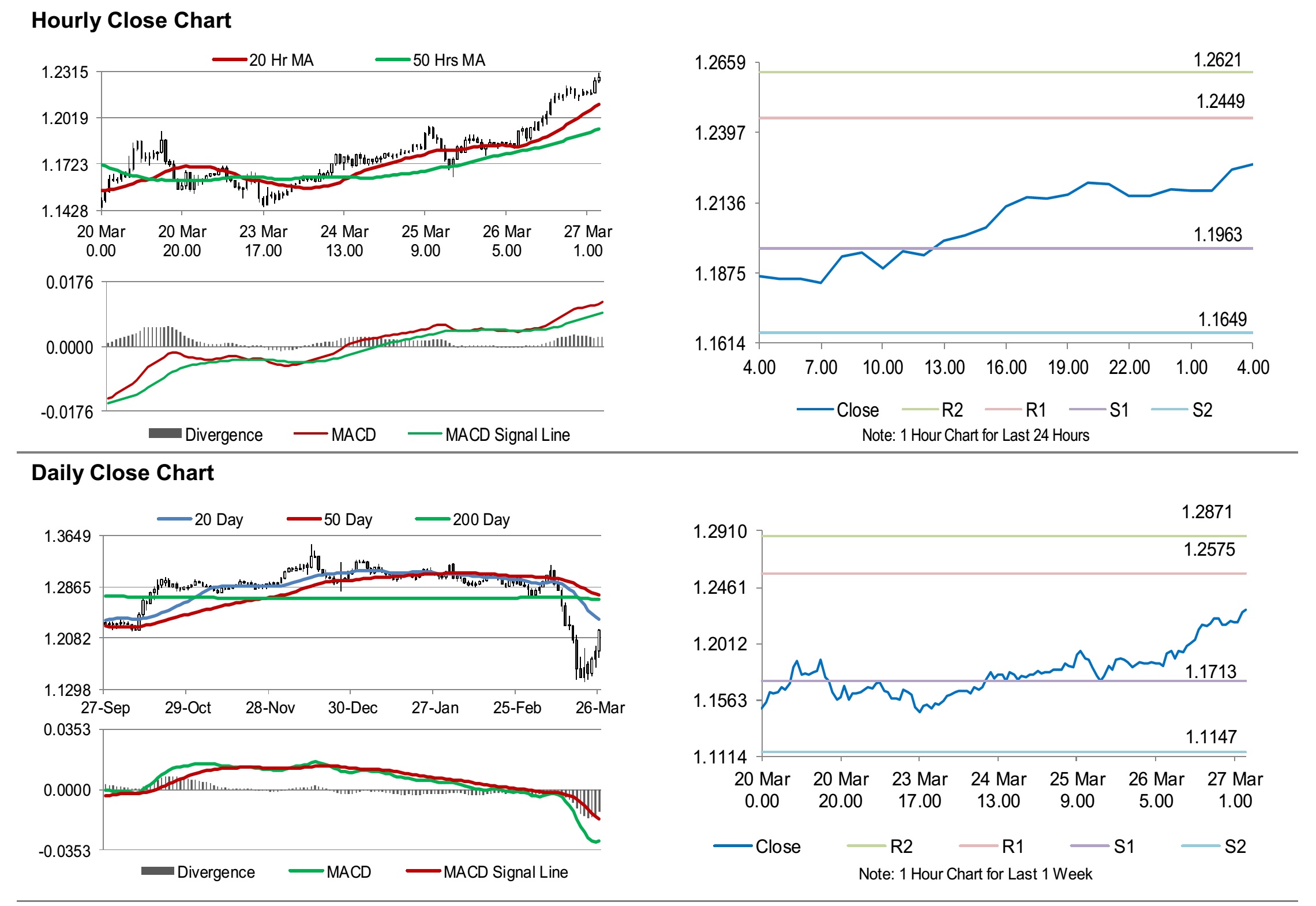

In the Asian session, at GMT0400, the pair is trading at 1.2278, with the GBP trading 0.95% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1963, and a fall through could take it to the next support level of 1.1649. The pair is expected to find its first resistance at 1.2449, and a rise through could take it to the next resistance level of 1.2621.

Looking ahead, investors would keep a watch on UK’s Nationwide housing prices for March, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.