For the 24 hours to 23:00 GMT, the USD rose 0.21% against the CAD to close at 1.1011. The Canadian Dollar lost ground after the Bank of Canada (BoC) kept its benchmark interest rate unchanged at 1.0% for the 29th straight policy meeting and after the BoC Governor, Stephen Poloz maintained his “neutral” stance on the direction of the interest rate, by indicating that “rate cuts cannot be taken off the table at this stage.” Negative sentiment was also fuelled after the BoC, in its Monetary Policy Report, slashed its projections on the growth of the Canadian economy to 2.3% this year, from its January forecast of 2.5%, amid concerns on reduced contribution by business investment. However, the central bank maintained its 2015 growth estimate at 2.5% and further issued the first estimate of 2016 growth at 2.2%.

In the Asian session, at GMT0300, the pair is trading at 1.1005, with the USD trading marginally lower from yesterday’s close.

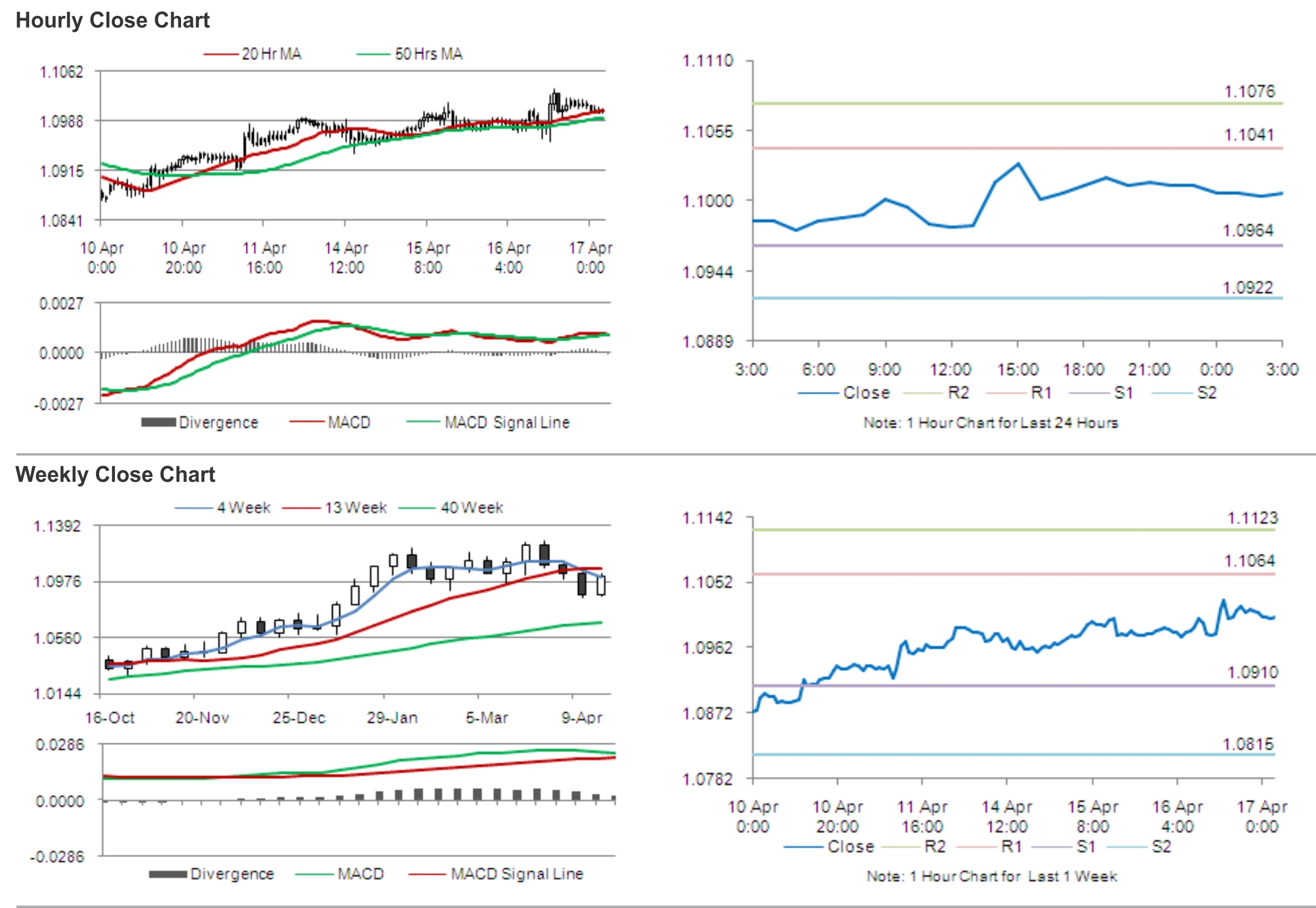

The pair is expected to find support at 1.0964, and a fall through could take it to the next support level of 1.0922. The pair is expected to find its first resistance at 1.1041, and a rise through could take it to the next resistance level of 1.1076.

Traders keenly await the release of Canada’s consumer inflation data, which is widely expected to rise on a yearly basis in March.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.