For the 24 hours to 23:00 GMT, the USD rose 0.18% against the CAD and closed at 1.2456.

The Canadian Dollar lost ground against the USD, after the Bank of Canada (BoC), at its latest monetary policy meeting, cautioned that uncertainty linked to the future of NAFTA is clouding the economic outlook.

The BoC, as widely anticipated, raised the key interest rate by a quarter percentage point to 1.25%, on the backdrop of a recovery in inflation and a sustained growth in the economic activity. In a post-meeting statement, the central bank stated that while higher interest rates would be warranted over time, some continued monetary policy accommodation will likely be needed to support growth and inflation. However, the central bank also highlighted that the economic outlook remains marred by the future of North American Free Trade Agreement (NAFTA), as its uncertainty was causing investments to be postponed or diverted.

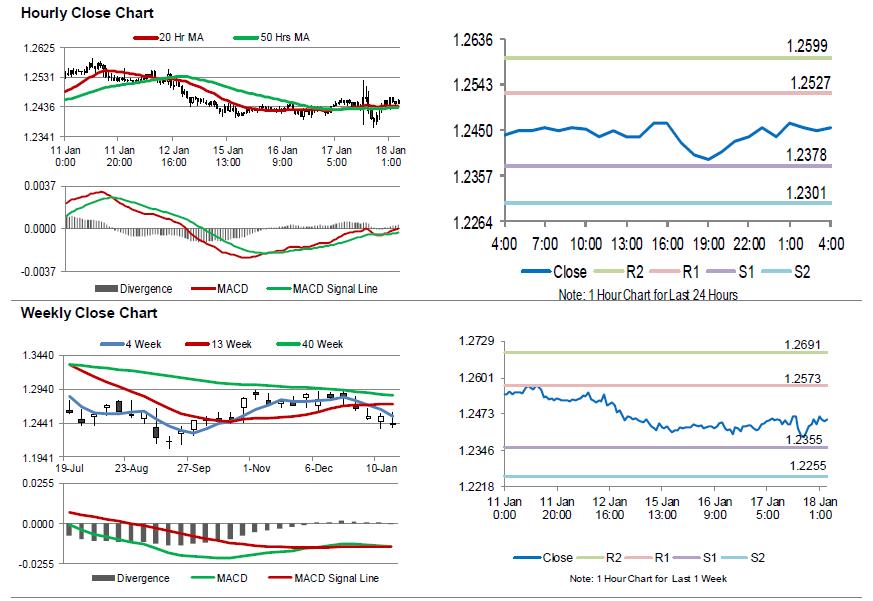

In the Asian session, at GMT0400, the pair is trading at 1.2456, with the USD trading flat against the CAD from yesterday’s close.

The pair is expected to find support at 1.2378, and a fall through could take it to the next support level of 1.2301. The pair is expected to find its first resistance at 1.2527, and a rise through could take it to the next resistance level of 1.2599.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.