For the 24 hours to 23:00 GMT, the USD declined 0.76% against the CAD and closed at 1.2738.

The Canadian Dollar gained ground against the USD, following a pair of upbeat Canadian economic reports.

Data showed that Canada’s consumer price index (CPI) jumped more-than-expected by 2.1% on a yearly basis in November, rising by the most in ten months and led by an increase in gasoline and food prices. In the prior month, the CPI had advanced 1.4%, while market participants had envisaged for a gain of 2.0%.

Additionally, the nation’s retail sales grew at its fastest pace in nine months, after it climbed 1.5% on a monthly basis in October, thus offering evidence of strength in the nation’s consumer spending. Investors had anticipated retail sales to rise 0.3%, after recording a revised advance of 0.2% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.2742, with the USD trading marginally higher against the CAD from yesterday’s close.

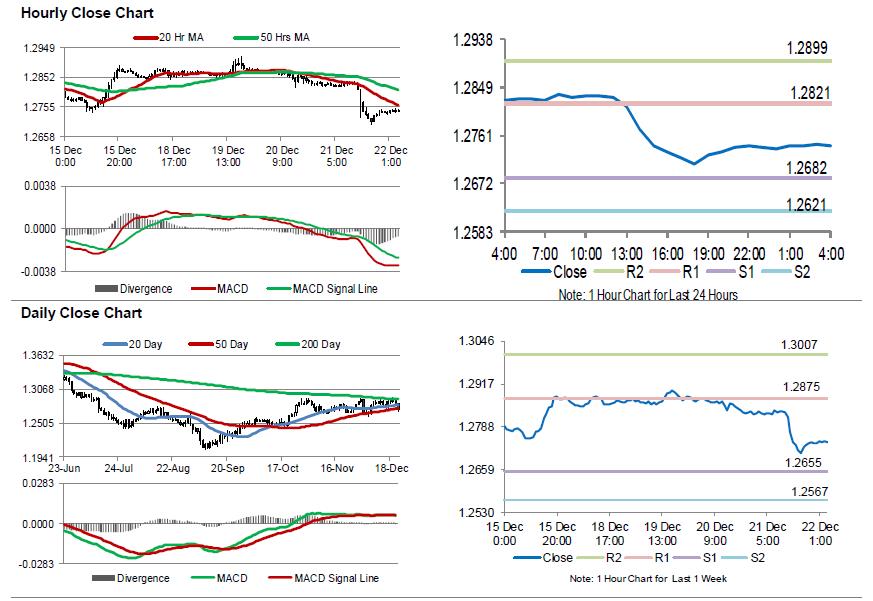

The pair is expected to find support at 1.2682, and a fall through could take it to the next support level of 1.2621. The pair is expected to find its first resistance at 1.2821, and a rise through could take it to the next resistance level of 1.2899.

Trading trend in the CAD today is expected to be determined by the release of crucial Canadian gross domestic product (GDP) report for October, due later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.