For the 24 hours to 23:00 GMT, the USD declined 0.67% against the CAD and closed at 1.2407 on Friday.

The Canadian Dollar gained ground against the USD, after stronger-than-expected data on Canada’s labour market boosted odds for a January interest rate hike.

Data revealed that Canada’s unemployment rate unexpectedly fell to a four-decade low of 5.7% in December, on the back of a surge in job creation, thus highlighting a rapidly diminishing slack in the nation’s labour market. In the prior month, the unemployment rate had recorded a level of 5.9%, while market participants had envisaged for a rise to a level of 6.0%.

Other data showed that Canada’s seasonally adjusted Ivey–PMI fell to a level of 60.4, compared to a reading of 63.0 in the previous month. Moreover, the nation’s international merchandise trade deficit surprisingly expanded to C$2.54 billion in November, after recording a revised deficit of C$1.55 billion in the prior month and confounding market expectations for the nation’s trade deficit to narrow to C$1.13 billion.

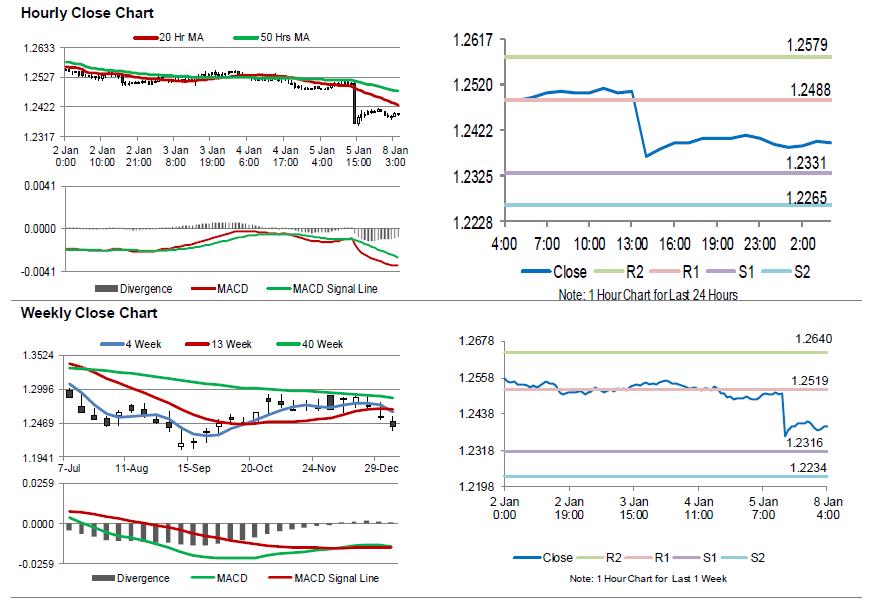

In the Asian session, at GMT0400, the pair is trading at 1.2397, with the USD trading 0.08% lower against the CAD from Friday’s close.

The pair is expected to find support at 1.2331, and a fall through could take it to the next support level of 1.2265. The pair is expected to find its first resistance at 1.2488, and a rise through could take it to the next resistance level of 1.2579.

Going forward, the Bank of Canada’s (BoC) business outlook survey report, scheduled to release later in the day, would be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.