For the 24 hours to 23:00 GMT, the USD declined 0.08% against the CAD and closed at 1.3311 on Friday.

Macroeconomic data revealed that Canada’s consumer price index (CPI) unexpectedly fell 0.2% on a monthly basis in December, following a drop of 0.4% in the prior month, while market anticipation was for the CPI to record a flat reading. Meanwhile, on an annual basis, the CPI climbed less-than-forecasted by 1.5% in December, reinforcing views that the Bank of Canada will remain on hold for the foreseeable future. The CPI increased 1.2% in the prior month, compared to market anticipation for a gain of 1.7%. Additionally, the nation’s retail sales advanced less-than-expected by 0.2% on a monthly basis in November, against market consensus for an advance of 0.5%. In the prior month, retail sales had registered a revised rise of 1.2%.

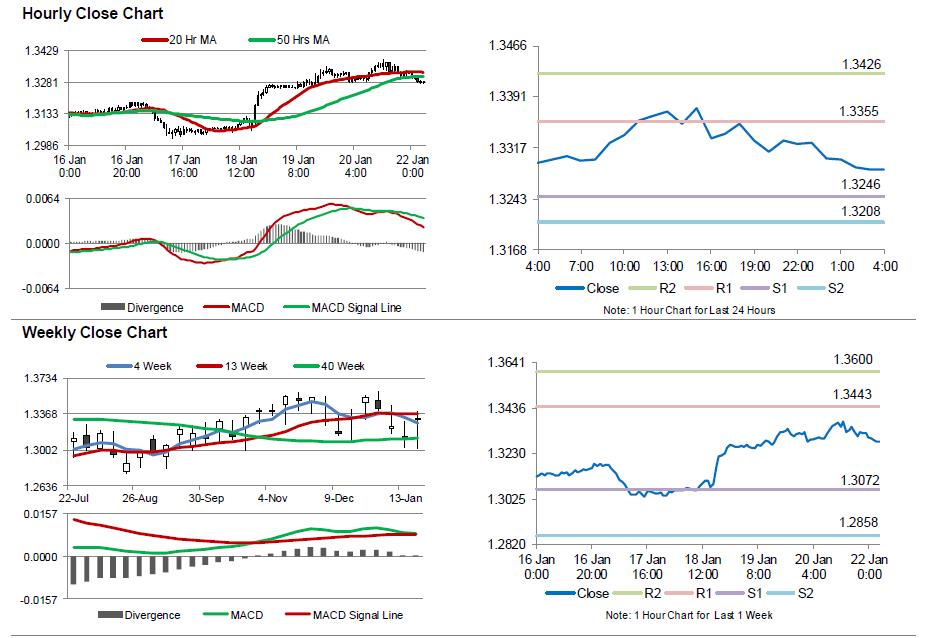

In the Asian session, at GMT0400, the pair is trading at 1.3285, with the USD trading 0.2% lower against the CAD from Friday’s close.

The pair is expected to find support at 1.3246, and a fall through could take it to the next support level of 1.3208. The pair is expected to find its first resistance at 1.3355, and a rise through could take it to the next resistance level of 1.3426.

Looking ahead, investors will focus on Canada’s wholesale sales for November, due to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.