For the 24 hours to 23:00 GMT, the USD declined 0.19% against the CHF and closed at 0.8818. The Swiss Franc advanced following data that showed the Swiss economy posted a trade surplus of CHF2.1 billion in March and that exports in the nation advanced 4.0% in March, while imports fell by real 1.0%.

Meanwhile, during a conference in Bern, the Swiss National Bank (SNB) Vice President, Jean-Pierre Danthine cautioned that “the dynamics of the credit sector, mortgage sector have been very strong” and that it has put the economy in the danger zone. Furthermore, he also indicated that the central bank cannot make any changes in its interest rate policy in order to bring down high residential property prices.

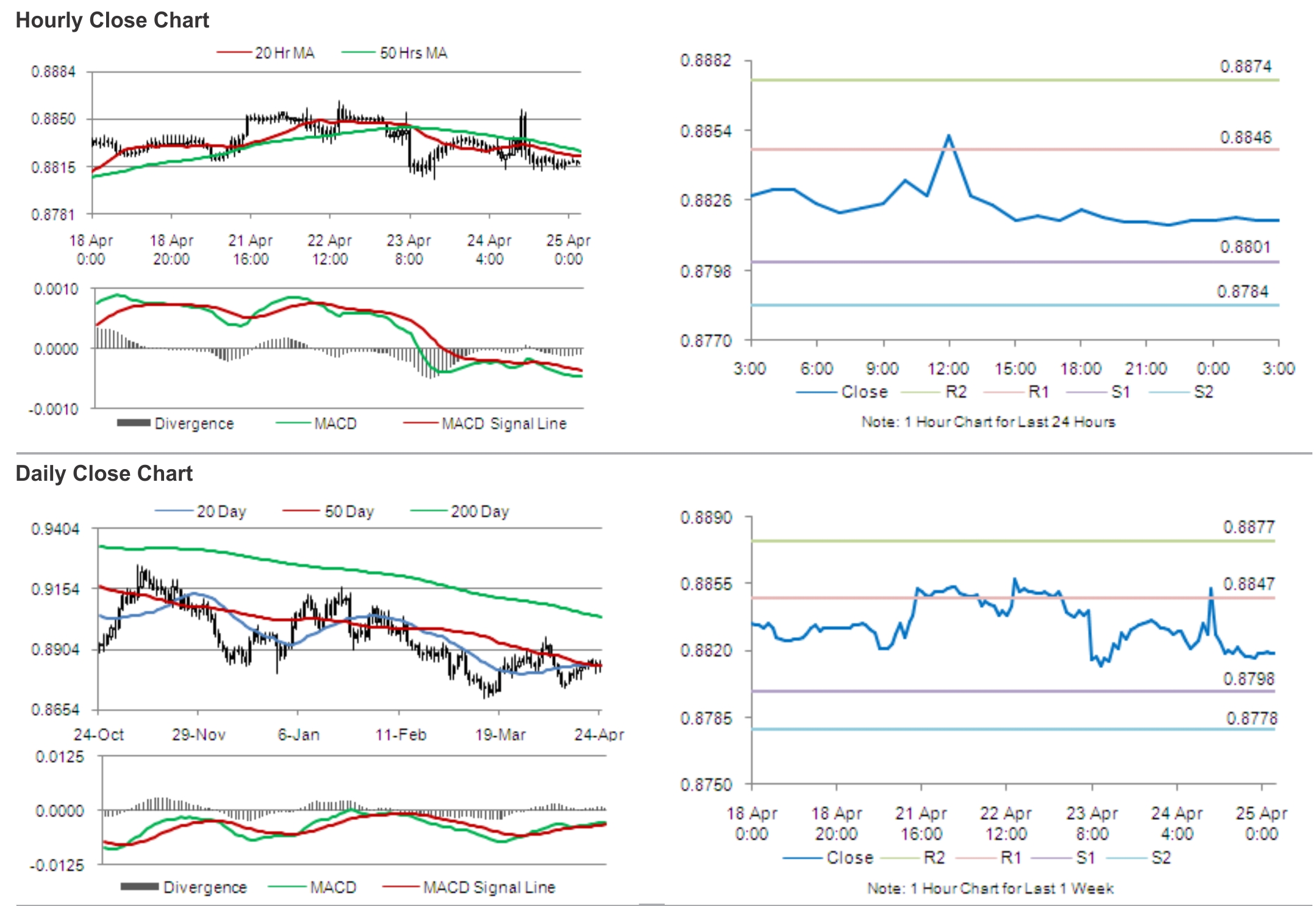

In the Asian session, at GMT0300, the pair is trading at 0.8818, with the USD trading flat from yesterday’s close.

The pair is expected to find support at 0.8801, and a fall through could take it to the next support level of 0.8784. The pair is expected to find its first resistance at 0.8846, and a rise through could take it to the next resistance level of 0.8874.

With no major economic releases in Switzerland, traders would eye global economic news for further cues in the currency pair.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.