For the 24 hours to 23:00 GMT, the USD declined 0.45% against the CHF and closed at 0.9549.

In economic news, Switzerland’s real retail sales declined by 1.3% YoY in March, following a revised 0.4% fall in the previous month. On the other hand, the nation’s SVME purchasing managers index unexpectedly rose to a level of 54.7 in April, compared to market expectations of a drop to a level of 52.9. The index had recorded a reading of 53.2 in the prior month.

On Friday, the SNB Chairman, Thomas Jordan, indicated that the central bank would not hesitate from using unconventional monetary policy measures in the face of a “significantly overvalued” domestic currency, if it is in the best interest of the nation.

In other economic news, Switzerland’s KOF leading indicator dropped to a level of 102.7 in April, compared to market expectations of a fall to a level of 102.5. In the prior month, the indicator had registered a revised reading of 102.8.

In the Asian session, at GMT0300, the pair is trading at 0.9539, with the USD trading 0.11% lower from yesterday’s close.

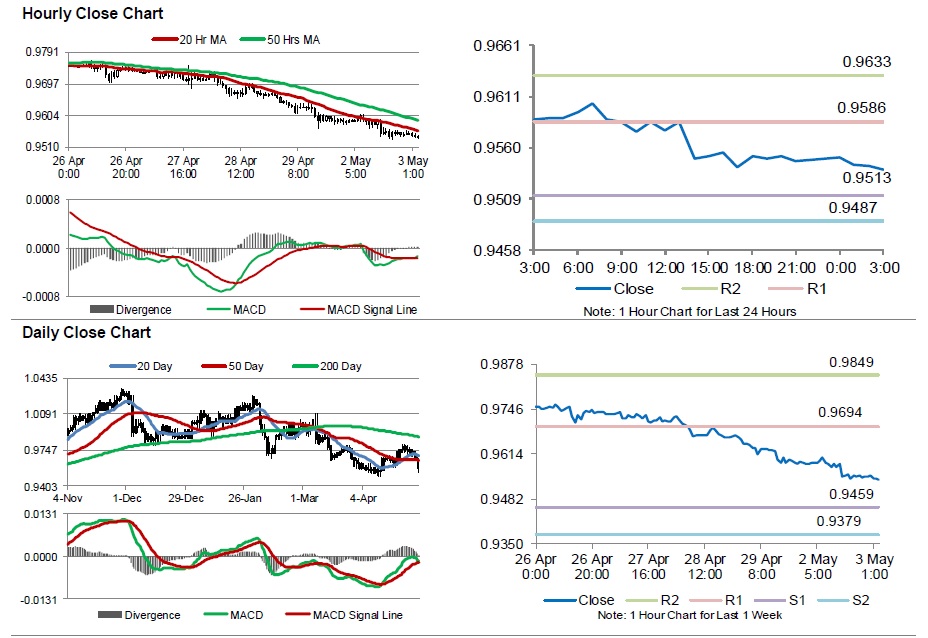

The pair is expected to find support at 0.9513, and a fall through could take it to the next support level of 0.9487. The pair is expected to find its first resistance at 0.9586, and a rise through could take it to the next resistance level of 0.9633.

Moving ahead, investors will look forward to the release of Switzerland’s SECO consumer confidence index data for April, due in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.