For the 24 hours to 23:00 GMT, the USD declined 0.29% against the CHF and closed at 1.0059.

In economic news, data revealed that Switzerland’s KOF leading indicator rose more-than-expected to a level of 107.2 in February, compared to a revised reading of 102.0 in the prior month, whereas markets were expecting the KOF economic barometer to advance to a level of 102.1.

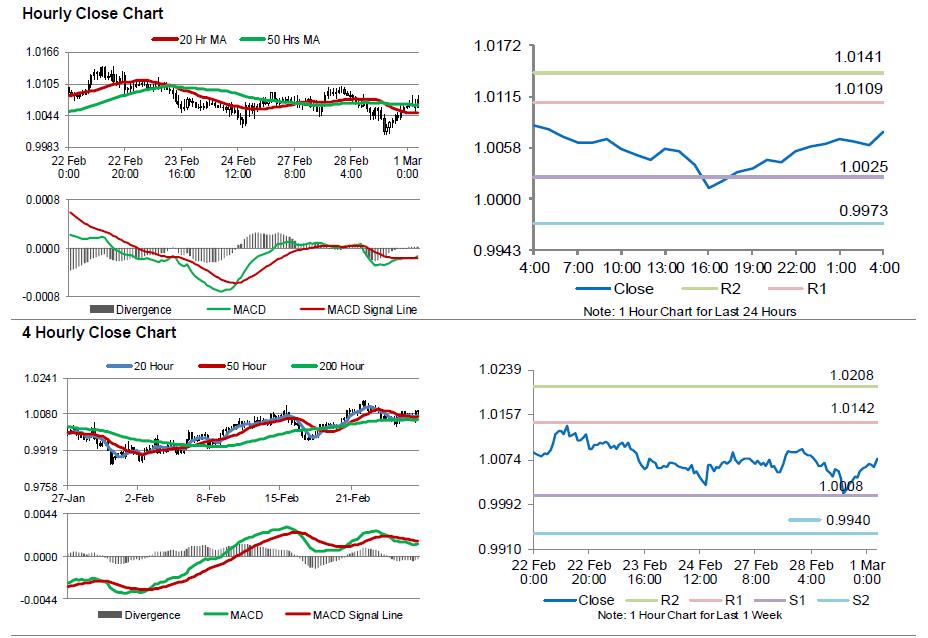

In the Asian session, at GMT0400, the pair is trading at 1.0076, with the USD trading 0.17% higher against the CHF from yesterday’s close.

The pair is expected to find support at 1.0025, and a fall through could take it to the next support level of 0.9973. The pair is expected to find its first resistance at 1.0109, and a rise through could take it to the next resistance level of 1.0141.

Going ahead, market participants await the release of Switzerland’s UBS consumption indicator for January and SVME–PMI for February, both set to release in a few hours.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.