For the 24 hours to 23:00 GMT, the USD declined 0.59% against the CHF and closed at 1.0102.

The Swiss Franc gained ground, after Switzerland’s SVME-purchasing mangers’ index unexpectedly advanced to a level of 56.6 in November, rising for the fourth consecutive month and touching its highest level since February 2014. Market anticipated the index to decline to a level of 54.4, compared to a level of 54.7 in the previous month. On the contrary, the nation’s real retail sales dropped less-than-expected by 0.5% YoY in October, following a revised fall of 2.1% in the prior month, while markets expected it to ease by 2.2%.

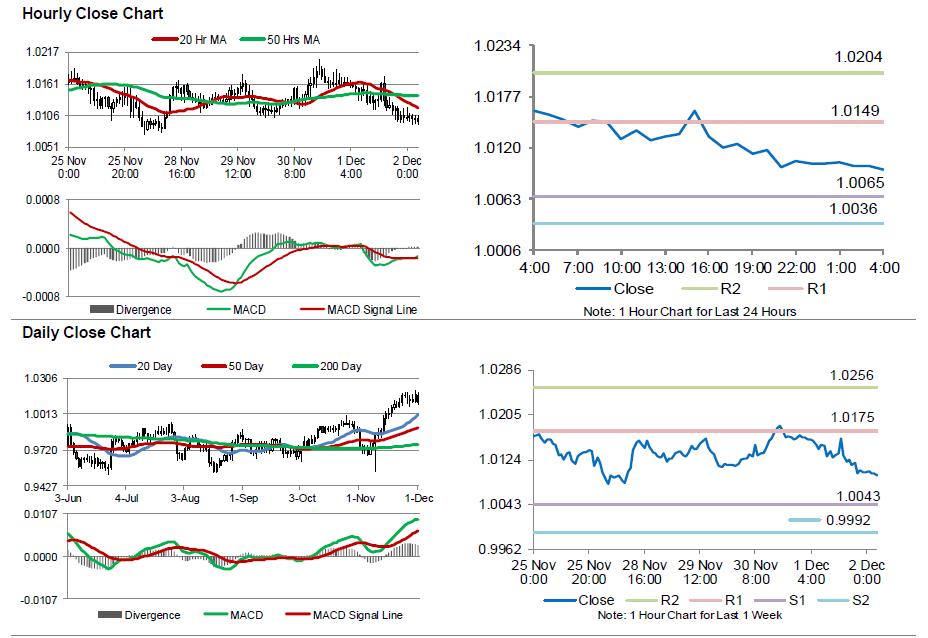

In the Asian session, at GMT0400, the pair is trading at 1.0095, with the USD trading 0.07% lower against the CHF from yesterday’s close.

The pair is expected to find support at 1.0065, and a fall through could take it to the next support level of 1.0036. The pair is expected to find its first resistance at 1.0149, and a rise through could take it to the next resistance level of 1.0204.

Moving ahead, investors would concentrate on Switzerland’s third quarter GDP data, slated to release in some time.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.