For the 24 hours to 23:00 GMT, the USD strengthened 0.48% against the JPY and closed at 109.31.

On the macro front, Japan’s vehicle production slid 2.6% on an annual basis in September after registering a fall of 6.7% in August.

In the Asian session, at GMT0400, the pair is trading at 109.36, with the USD trading marginally higher from yesterday’s close. The Japanese Yen also came under pressure after the BoJ unexpectedly stated that it would expand the nation’s monetary base to ¥80 trillion per year, from its earlier targeted level of ¥60-70 trillion.

In other economic news, Japan’s annual national consumer price index advanced 3.2% in September, less than market expectations for a rise of 3.3% and compared to a similar level registered in the prior month.

In other economic news, the nation’s jobless rate came in at 3.6% in September, at par with market expectations. On the other hand, household spending dropped 5.6% in September on an annual basis, more than market expected decline of 4.3% and compared to a drop of 4.7 registered in August.

Data just released indicated that, housing starts in Japan fell 14.3% on a YoY basis in September, higher than market expected drop of 17.5%, while construction orders dropped 40.3% on an annual basis in September, after registering a rise of 8.6% in August,

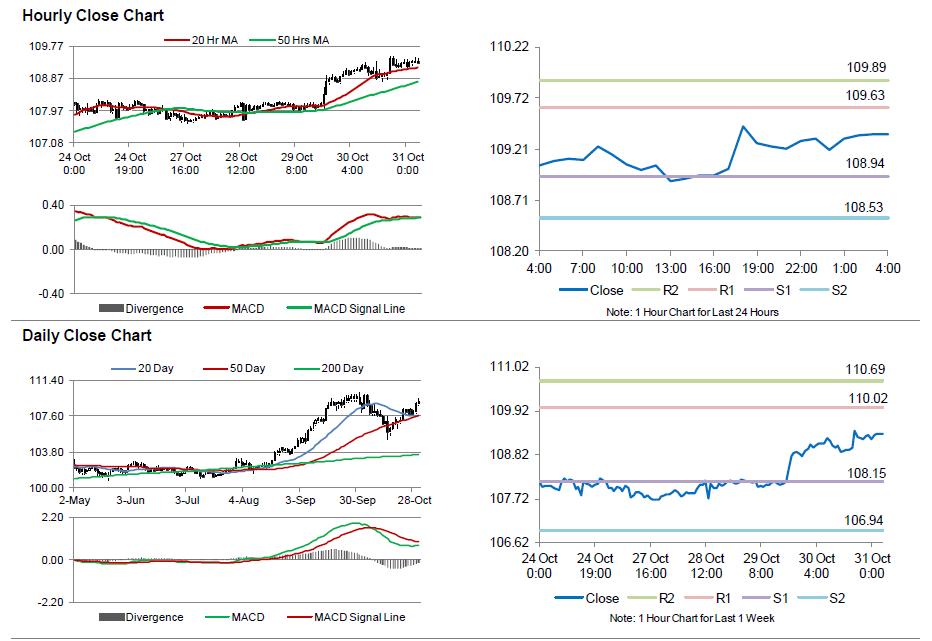

The pair is expected to find support at 108.94, and a fall through could take it to the next support level of 108.53. The pair is expected to find its first resistance at 109.63, and a rise through could take it to the next resistance level of 109.89.

Meanwhile, investors look forward to the BoJ’s outlook report, scheduled shortly.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.