For the 24 hours to 23:00 GMT, the USD strengthened 1.29% against the JPY and closed at 106.05.

In economic news, Japan’s final leading economic index dropped to a level of 100.0 in April, from a preliminary reading of 100.5. In the previous month, the index had registered a reading of 99.3. Further, the nation’s final coincident index fell to a level of 112.0 in April, compared to the preliminary reading of 112.2 and after recording a reading of 111.1 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 101.50, with the USD trading 4.29% lower against the JPY from yesterday’s close.

Overnight, a summary of opinions from the Bank of Japan’s (BoJ) June 15-16 meeting, showed that the policymakers remained deeply divided on whether to expand or scale back its massive stimulus program, but eventually decided to keep the monetary policy steady. While several board members said the BoJ should hold off from expanding stimulus for now in order to scrutinize the impact of January’s decision to adopt negative interest rates, a few others called for an expansion in stimulus to achieve the inflation target.

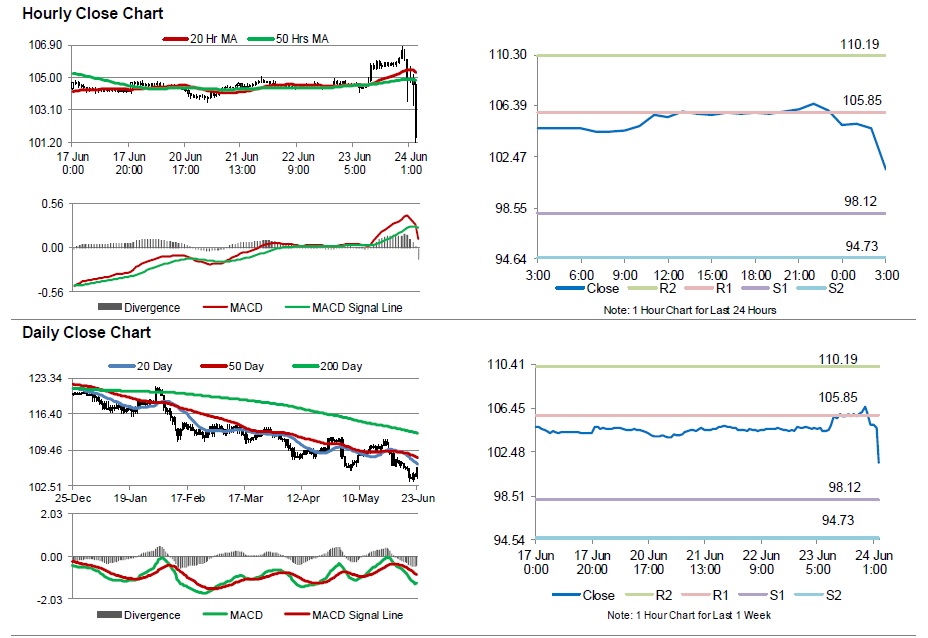

The pair is expected to find support at 98.12, and a fall through could take it to the next support level of 94.73. The pair is expected to find its first resistance at 105.85, and a rise through could take it to the next resistance level of 110.19.

Moving ahead, investors look forward to Japan’s industrial production, unemployment rate, consumer prices and the Tankan survey data, all scheduled to release next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.