For the 24 hours to 23:00 GMT, the USD declined 0.45% against the JPY and closed at 113.13.

In the Asian session, at GMT0400, the pair is trading at 113.16, with the USD trading marginally higher from yesterday’s close.

The Bank of Japan (BoJ), at its latest monetary policy meeting, left its short-term interest rate unchanged at -0.1% by a majority vote of 8-1 and held its asset purchases at an annual pace of ¥80.0 trillion, as expected. In its outlook report, the central bank maintained its forecast for inflation to hit 2.0% in the fiscal year 2019/2020. However, it trimmed its projections for core consumer prices for the fiscal year 2017/2018. The CPI is now expected to rise 0.8% in the current fiscal year, down from the previous projection of 1.1%. BoJ’s new board member, Goushi Kataoka, who dissented from the BoJ’s decision to maintain its interest rate targets, argued that the central bank should signal its willingness to increase stimulus if there is a delay in achieving the 2.0% inflation target.

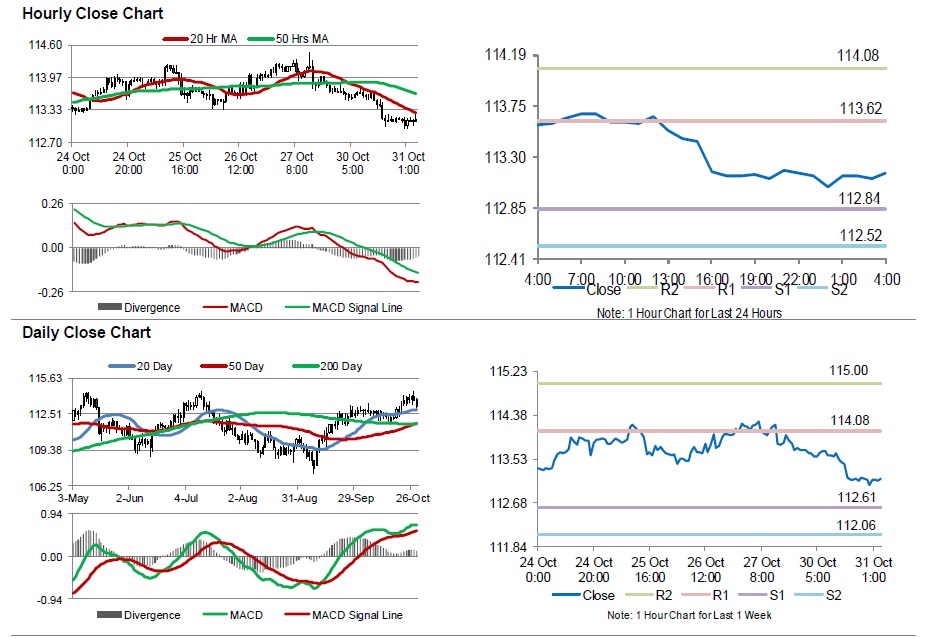

The pair is expected to find support at 112.84, and a fall through could take it to the next support level of 112.52. The pair is expected to find its first resistance at 113.62, and a rise through could take it to the next resistance level of 114.08.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.