For the 24 hours to 23:00 GMT, the USD rose 0.43% against the JPY and closed at 113.35.

In the Asian session, at GMT0400, the pair is trading at 113.4, with the USD trading slightly higher against the JPY from yesterday’s close.

Earlier today, the Bank of Japan (BoJ), at its latest monetary policy meeting, voted 8-1 to maintain the benchmark interest rate steady at -0.10% and its target for 10-year Japanese government bond yields at around 0.0%. Further, the central bank upgraded its assessments on private consumption and capital expenditure, amid improvement in corporate profits and business sentiment.

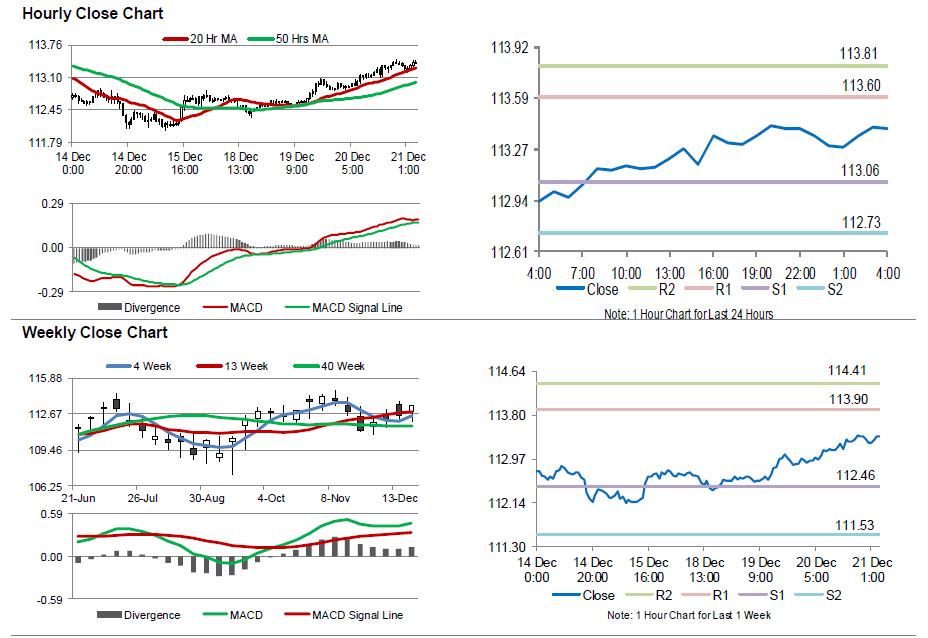

The pair is expected to find support at 113.06, and a fall through could take it to the next support level of 112.73. The pair is expected to find its first resistance at 113.60, and a rise through could take it to the next resistance level of 113.81.

Going ahead, investors will look forward to comments by the BoJ Governor, Haruhiko Kuroda, in a post-meeting news conference, scheduled in a few hours, for further clues on the central bank’s monetary policy trajectory.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.