For the 24 hours to 23:00 GMT, the USD declined 0.18% against the JPY and closed at 109.33.

In the Asian session, at GMT0400, the pair is trading at 109.71, with the USD trading 0.35% higher against the JPY from yesterday’s close.

Overnight data showed that Japan’s (total) trade deficit narrowed to a level of ¥55.3 billion in December, amid decline in exports for the first time in 2 years and following a deficit of ¥737.7 billion in the prior month. Market participants had envisaged the nation to record a deficit of ¥35.3 billion.

Earlier in the session, the Bank of Japan, held its benchmark interest rate unchanged at -0.10%. Meanwhile, the central bank slashed its quarterly inflation outlook, amid mounting trade tensions and global uncertainty. However, the bank upgraded its economic growth forecast to 0.9% for the year starting April, from 0.8%.

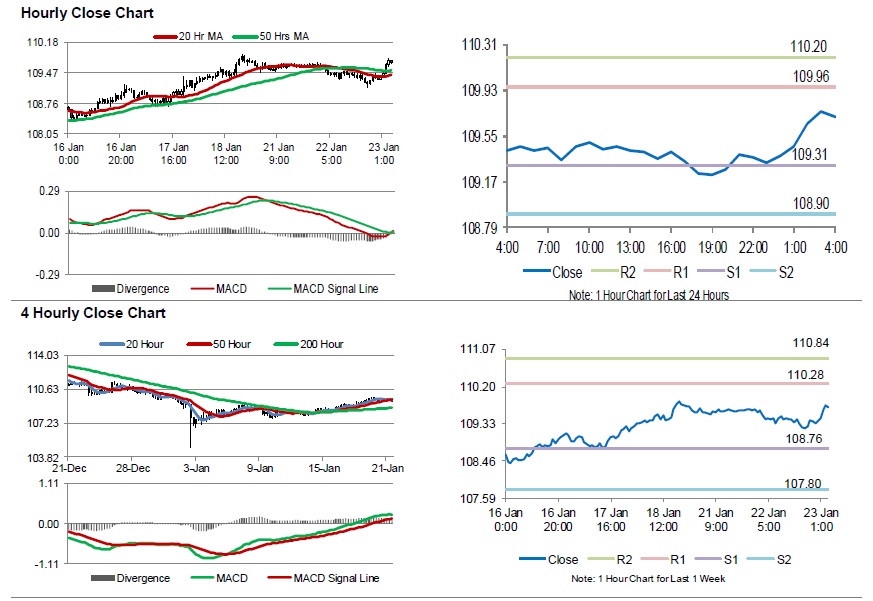

The pair is expected to find support at 109.31, and a fall through could take it to the next support level of 108.90. The pair is expected to find its first resistance at 109.96, and a rise through could take it to the next resistance level of 110.20.

Trading trend in the Japanese Yen today is expected to be determined by Japan’s machine tool orders for December, scheduled to release in a while.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.