For the 24 hours to 23:00 GMT, the USD strengthened 0.06% against the JPY and closed at 101.47.

Economic data from the Cabinet Office released yesterday indicated that Japan’s leading economic index declined to the lowest level since January 2013 while the coincident index edged up slightly in May. The final leading economic index declined to 104.8 in May, compared to a level of 106.5 reported in the previous month. Meanwhile, the final coincident index rose to a level of 111.3 in May from a level of 111.1 in the previous month. Meanwhile, the lagging index was revised down to 117.8 in May from 117.9 in April.

In the Asian session, at GMT0300, the pair is trading at 101.42, with the USD trading 0.05% lower from yesterday’s close.

Earlier today, Bank of Japan Deputy Governor, Hiroshi Nakaso expressed confidence on the pace of economic recovery in Japan by indicating that the nation may finally come out of deflation territory after almost two decades, as rising wages and inflation expectations enable companies to increase prices of their goods.

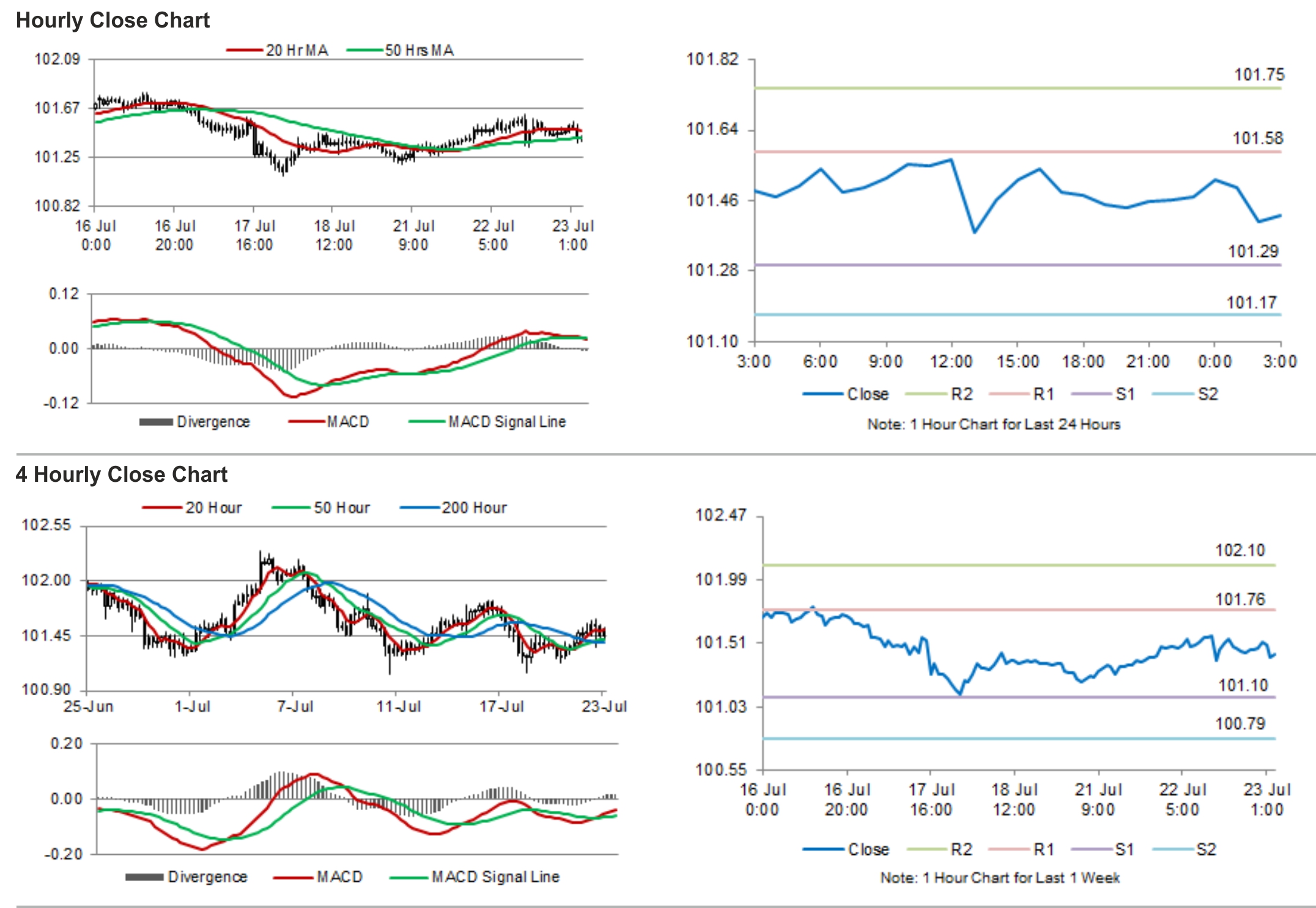

The pair is expected to find support at 101.29, and a fall through could take it to the next support level of 101.17. The pair is expected to find its first resistance at 101.58, and a rise through could take it to the next resistance level of 101.75.

The trade balance data from Japan would be keenly eyed by investors, slated to release in the midnight.

The currency pair is trading just below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.