For the 24 hours to 23:00 GMT, the USD slightly declined against the JPY and closed at 110.83 on Friday.

The Bank of Japan (BoJ) Governor, Haruhiko Kuroda, stated that inflation is still far from reaching the BoJ’s 2.0% target and thus it is “inappropriate” to say how the central bank would exit its massive stimulus programme.

In the Asian session, at GMT0300, the pair is trading at 110.99, with the USD trading 0.14% higher against the JPY from Friday’s close.

Overnight data showed that Japan’s adjusted merchandise trade surplus surprisingly narrowed to a level of ¥133.8 billion in May, compared to market expectations for it to widen to a level of ¥345.5 billion and after recording a revised surplus of ¥157.6 billion in the prior month.

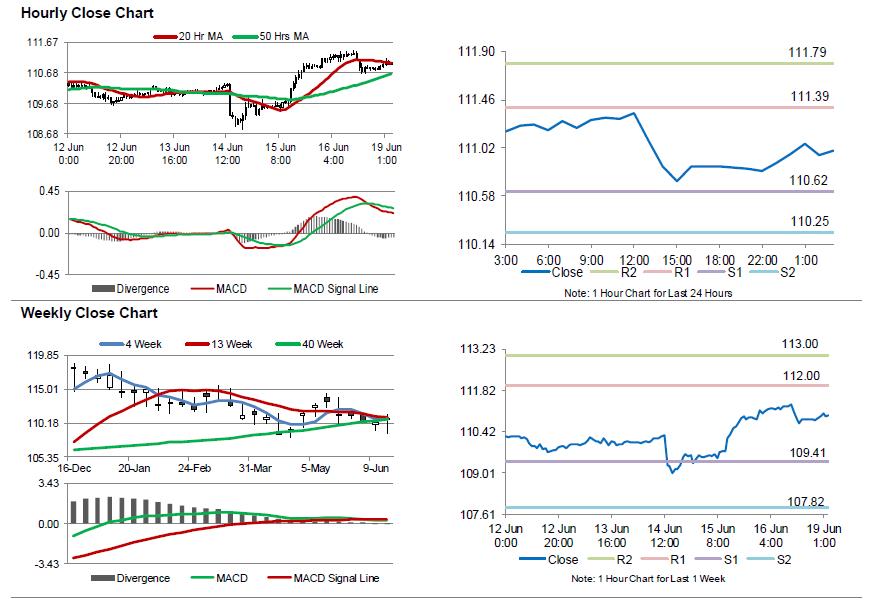

The pair is expected to find support at 110.62, and a fall through could take it to the next support level of 110.25. The pair is expected to find its first resistance at 111.39, and a rise through could take it to the next resistance level of 111.79.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.