For the 24 hours to 23:00 GMT, the USD weakened 0.24% against the JPY and closed at 119.20 as safe haven buying benefitted the Japanese yen.

In the Asian session, at GMT0400, the pair is trading at 119.32, with the USD trading 0.1% higher from yesterday’s close.

Earlier today, the national consumer price index in Japan rose 2.2% YoY in February, lower than market expected increase of 2.3% and compared to prior month’s 2.4% gain.

In other economic news, Japan’s jobless rate edged down to 3.5% in February, in line with market expectations, from prior month’s unemployment rate of 3.6%. Meanwhile, the nation’s seasonally adjusted retail trade rebounded 0.7% on a monthly basis in February, following a drop of 1.9% registered in the preceding month. Markets were expecting it to rise 0.9%.

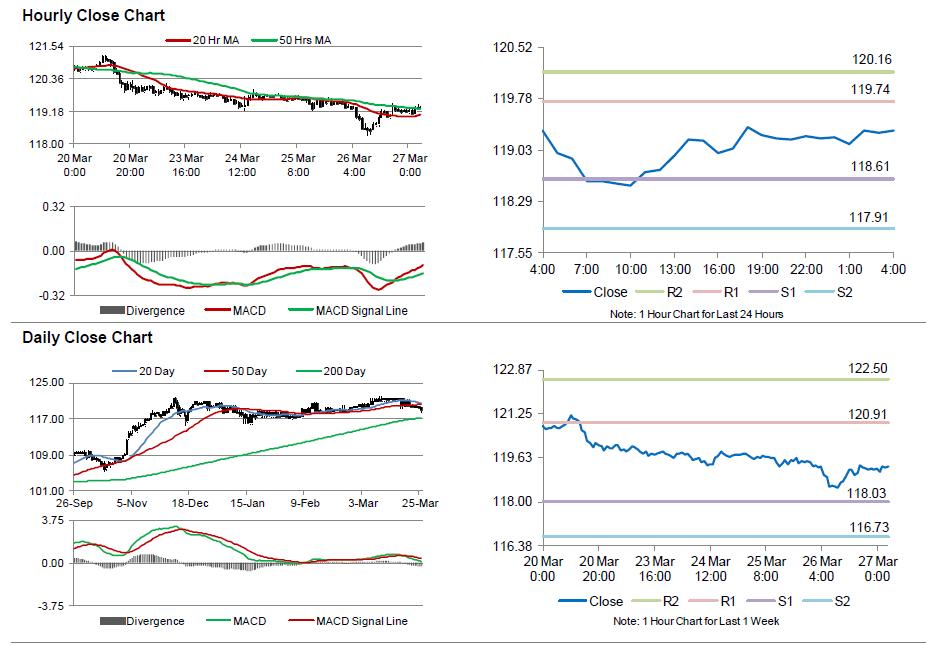

The pair is expected to find support at 118.61, and a fall through could take it to the next support level of 117.91. The pair is expected to find its first resistance at 119.74, and a rise through could take it to the next resistance level of 120.16.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.