For the 24 hours to 23:00 GMT, the USD strengthened 0.15% against the JPY and closed at 108.74.

In economic news, Japanese machine tool orders rose 35.5%, on an annual basis, in August, following a 37.7% increase in July.

Separately, the BoJ Governor, Haruhiko Kuroda, stated that despite recent economic data revealing weak industrial production and exports in Japan, but he continues to remain upbeat on the recovery of nation’s exports, citing improvements in the world economy.

In the Asian session, at GMT0300, the pair is trading at 109.16, with the USD trading 0.39% higher from yesterday’s close.

Early morning data indicated that, Japanese all industry activity index unexpectedly dropped 0.2% on a monthly basis in July, compared to a revised fall of 0.3% in the previous month. Markets were expecting it to remain flat.

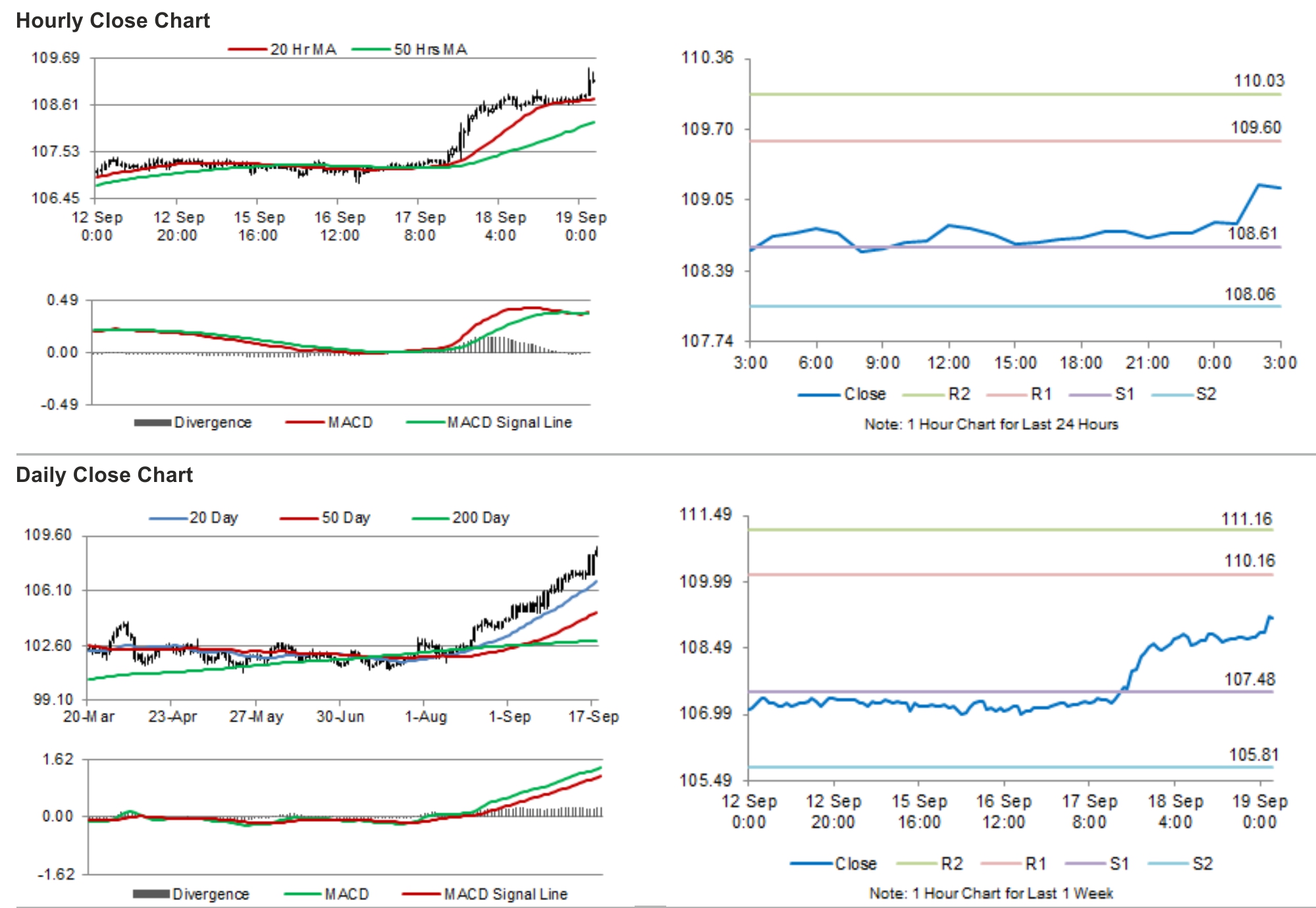

The pair is expected to find support at 108.61, and a fall through could take it to the next support level of 108.06. The pair is expected to find its first resistance at 109.6, and a rise through could take it to the next resistance level of 110.03.

Trading trends in the Yen today would be determined by Japan’s coincident and leading indices revealing the economic health of the nation, scheduled to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.