For the 24 hours to 23:00 GMT, the USD rose 0.11% against the JPY and closed at 100.54.

In the Asian session, at GMT0300, the pair is trading at 100.46, with the USD trading 0.08% lower against the JPY from yesterday’s close.

Overnight data revealed that, Japan’s national consumer price index (CPI) declined for a fifth consecutive month, after it fell by 0.4% YoY in July, in line with market expectations, thus piling pressure on the Bank of Japan to expand an already massive stimulus programme to kick-start inflation in the country. The CPI recorded a similar fall in the prior month.

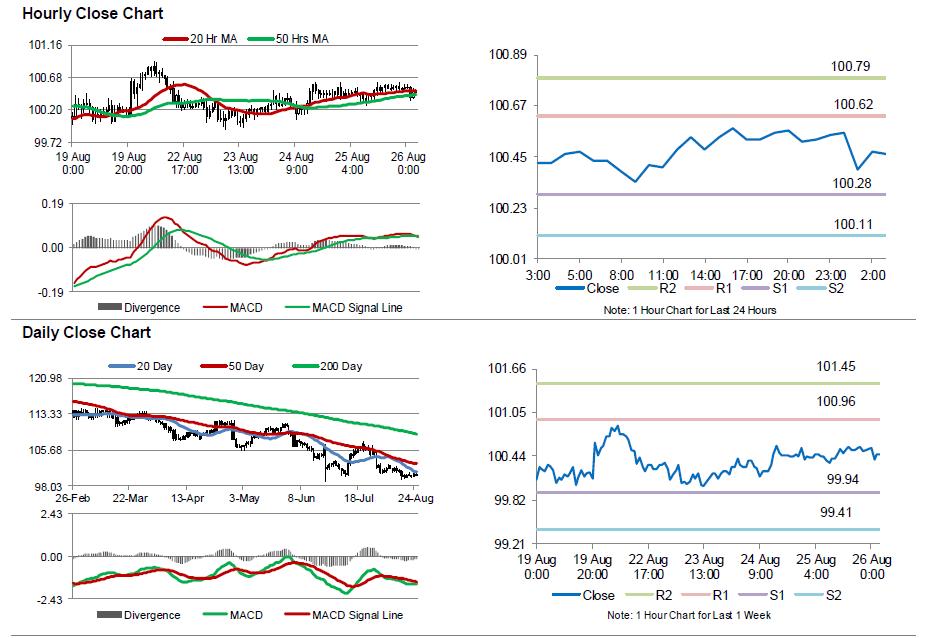

The pair is expected to find support at 100.28, and a fall through could take it to the next support level of 100.11. The pair is expected to find its first resistance at 100.62, and a rise through could take it to the next resistance level of 100.79.

Moving ahead, investors will look forward to Japan’s unemployment rate, retail trade, industrial production, consumer confidence and the Nikkei manufacturing PMI data, all scheduled to release next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.