For the 24 hours to 23:00 GMT, the USD marginally weakened against the JPY and closed at 119.86.

In the Asian session, at GMT0300, the pair is trading at 119.98, with the USD trading 0.1% higher from yesterday’s close.

Overnight data indicated that the Japanese unemployment rate unexpectedly edged up to 3.4% in August, from previous month’s level of 3.3%. Meanwhile, average household spending in Japan climbed 2.9% on an annual basis, marking its first gain in three months in August and topped consensus estimates for an increase of 0.3%. The household spending had contracted 0.2% in the previous month.

Other economic data revealed that the nation’s monetary base jumped 35.1% YoY in September, following a 33.3% spike in August.

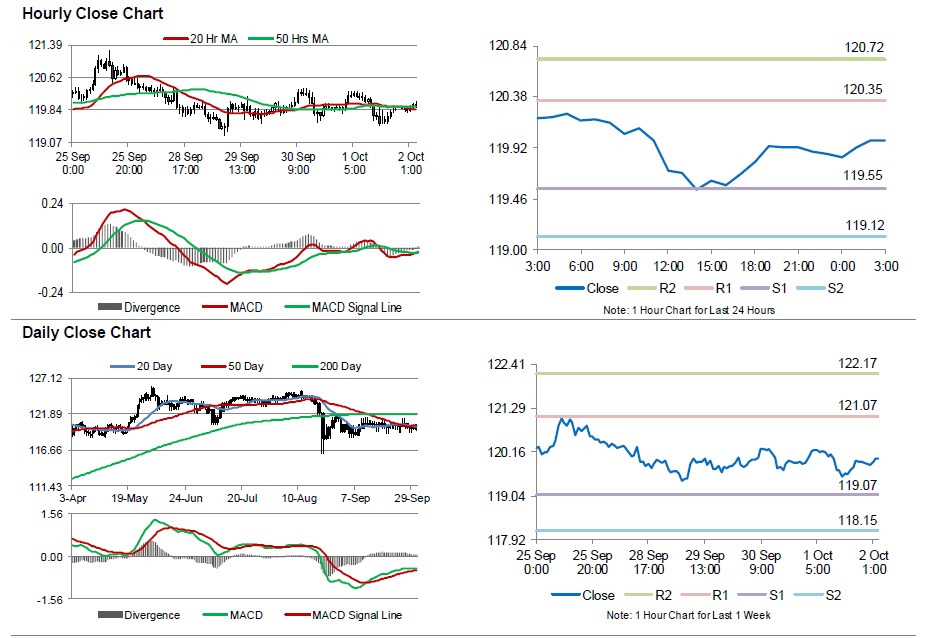

The pair is expected to find support at 119.55, and a fall through could take it to the next support level of 119.12. The pair is expected to find its first resistance at 120.35, and a rise through could take it to the next resistance level of 120.72.

Looking forward, the BoJ’s monetary policy statement, followed by the BoJ Governor, Haruhiko Kuroda’s press conference would be closely watched by market participants to gauge to strength of the Japanese economy.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.