For the 24 hours to 23:00 GMT, the USD weakened 0.43% against the JPY and closed at 109.68.

In the Asian session, at GMT0300, the pair is trading at 109.89, with the USD trading 0.19% higher from yesterday’s close.

Overnight data showed that, Japan’s national consumer price index (CPI) declined 0.3% YoY in April, dropping for the second consecutive month, stoking fresh fears of deflation and keeping the Bank of Japan under pressure to do more in order to achieve its 2.0% inflation target. Market anticipation was for the CPI to fall 0.4%, following a 0.1% drop in the previous month.

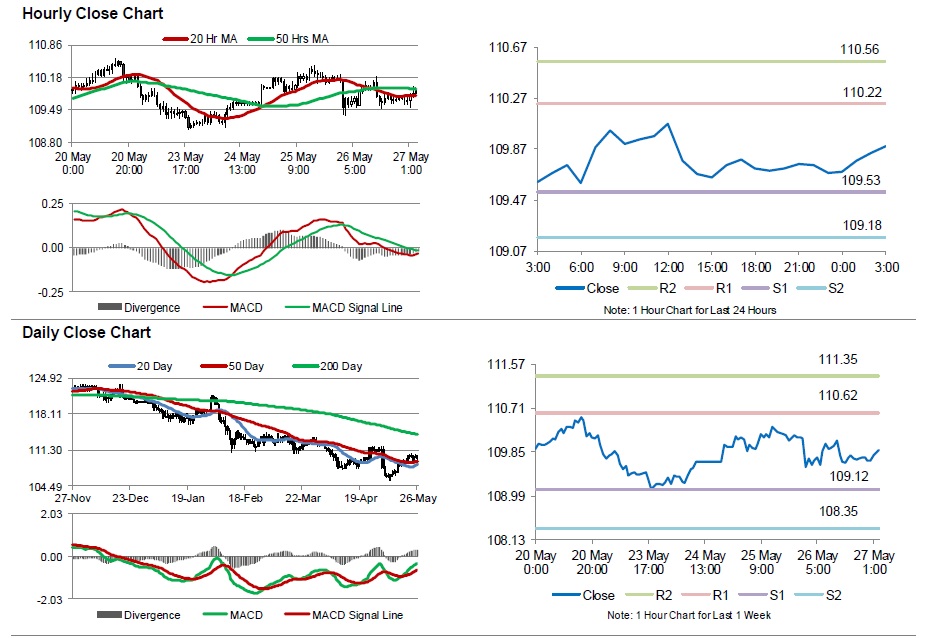

The pair is expected to find support at 109.53, and a fall through could take it to the next support level of 109.18. The pair is expected to find its first resistance at 110.22, and a rise through could take it to the next resistance level of 110.56.

Moving ahead, market participants will look forward to the release of Japan’s retail trade, unemployment rate, industrial production and the Nikkei manufacturing PMI data, all due next week.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.