For the 24 hours to 23:00 GMT, the USD strengthened 0.08% against the JPY and closed at 123.83.

Yesterday, the BoJ Governor, Haruhiko Kuroda, mentioned that he does not see any “asset bubble” emerging in the Japanese economy and added that he is not worried about the Yen.

In the Asian session, at GMT0300, the pair is trading at 123.71, with the USD trading 0.1% lower from yesterday’s close.

Earlier today, data showed that Japan’s national CPI rose 0.6% on an annual basis in April, at par with market expectations and compared to an advance of 2.3% in March. Meanwhile, the nation’s jobless rate unexpectedly fell to an 18-year low level of 3.3% in April, compared to a reading of 3.40% in the prior month, while markets expected it to remain unchanged.

In other economic news, Japan’s preliminary estimate of industrial production rebounded 1.0% MoM in April, following a 0.8% fall registered in the previous month. Also, household spending unexpectedly eased 1.30% on an annual basis in April, compared to a drop of 10.60% in the prior month. Markets were expecting it to advance 3.00%.

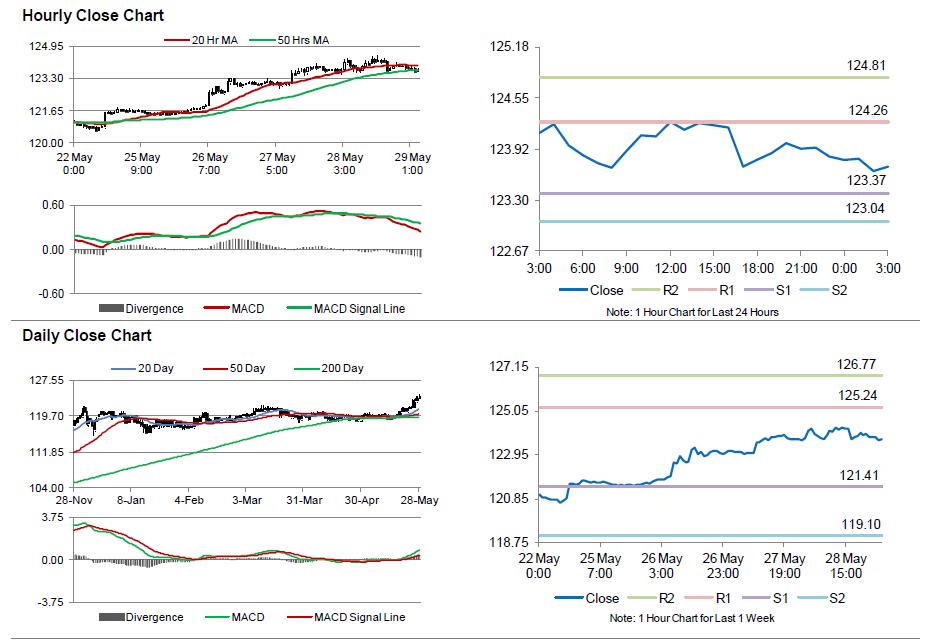

The pair is expected to find support at 123.37, and a fall through could take it to the next support level of 123.04. The pair is expected to find its first resistance at 124.26, and a rise through could take it to the next resistance level of 124.81.

Meanwhile, investors would monitor Japan’s housing starts data, scheduled in few hours for further cues.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.