For the 24 hours to 23:00 GMT, the USD declined 0.24% against the JPY and closed at 111.02.

In the Asian session, at GMT0400, the pair is trading at 111.28, with the USD trading 0.23% higher against the USD from yesterday’s close.

The Japanese Yen lost ground, after data indicated that Japan’s preliminary Nikkei manufacturing PMI dropped to a level of 52.6 in March, expanding at its slowest pace in three months as growth in new orders and output slowed. The PMI had recorded a level of 53.3 in the previous month.

Early morning data showed that the nation’s final leading economic index came in at 104.9 in January, while the preliminary figures had indicated a revised level of 104.8. Meanwhile, the nation’s final coincident index dropped less than initially estimated to a level of 115.1 in January, after registering a revised reading of 115.5 in the prior month and compared to a fall to a level of 114.9 in the flash print.

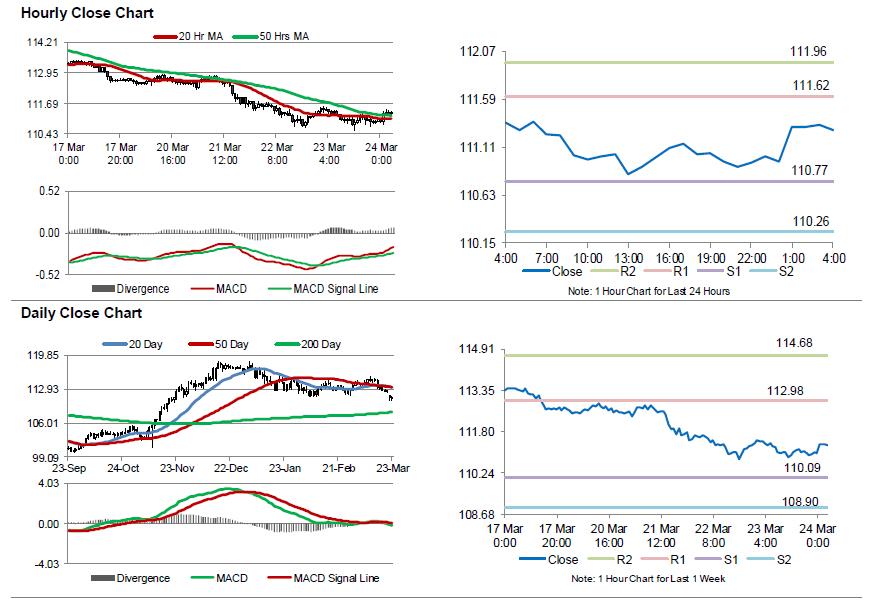

The pair is expected to find support at 110.77, and a fall through could take it to the next support level of 110.26. The pair is expected to find its first resistance at 111.62, and a rise through could take it to the next resistance level of 111.96.

Looking ahead, investors would await Bank of Japan’s summary of opinions report coupled with Japan’s jobless rate, national consumer price index, flash industrial production, retail trade and large retailers’ sales data, all slated to release next week.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.