For the 24 hours to 23:00 GMT, the USD rose 0.36% against the JPY and closed at 107.36.

In the Asian session, at GMT0400, the pair is trading at 107.2, with the USD trading 0.15% lower against the JPY from yesterday’s close.

The Japanese Yen gained ground against the USD, after the Bank of Japan (BoJ) reduced the amount of super-long Japanese government bonds (JGBs) it offered to buy at its regular debt buying operation.

On the macro front, Japan’s preliminary industrial production retreated more-than-anticipated by 6.6% on a monthly basis in January, dipping to its lowest level since March 2011. In the previous month, industrial production had registered a rise of 2.9%, while investors had envisaged for a fall of 4.0%.

Further, the nation’s retail trade registered a fall of 1.8% on a monthly basis in January, higher than market expectations for a drop of 0.6%. In the previous month, retail trade had climbed 0.9%. On the contrary, the nation’s large retailers’ sales rose 0.5% MoM in January, exceeding market expectations for an advance of 0.4%. In the prior month, large retailers’ sales had risen 1.1%.

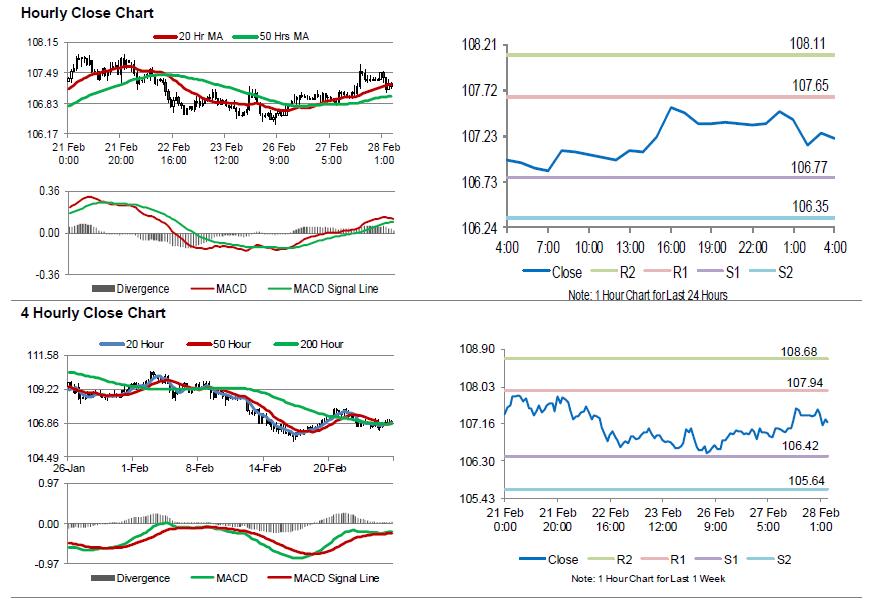

The pair is expected to find support at 106.77, and a fall through could take it to the next support level of 106.35. The pair is expected to find its first resistance at 107.65, and a rise through could take it to the next resistance level of 108.11.

Going ahead, traders would eye Japan’s final Nikkei manufacturing PMI and the consumer confidence index, both for February, due to release tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.