For the 24 hours to 23:00 GMT, the USD declined slightly against the JPY and closed at 111.02.

In the Asian session, at GMT0300, the pair is trading at 111.16, with the USD trading 0.13% higher against the JPY from yesterday’s close.

Overnight data indicated that Japan’s unemployment rate climbed to 2.4% in June, following a rate of 2.2% in the prior month. Market participants had anticipated unemployment rate to rise to 2.3%. Moreover, the nation’s flash industrial production unexpectedly declined 1.2% on a yearly basis in June, defying market expectations for an advance of 0.6%. In the preceding month, industrial production had increased 4.2%.

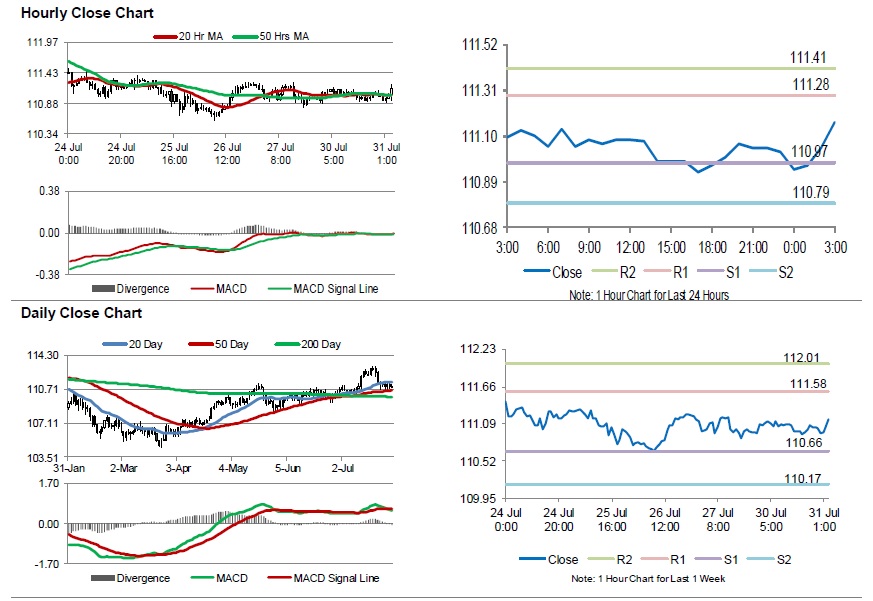

The pair is expected to find support at 110.97, and a fall through could take it to the next support level of 110.79. The pair is expected to find its first resistance at 111.28, and a rise through could take it to the next resistance level of 111.41.

Looking ahead, investors will keep an eye on Japan’s consumer confidence index for July, along with housing starts and construction orders, both for June, set to release in a while.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.