For the 24 hours to 23:00 GMT, the USD rose 0.06% against the JPY and closed at 113.87.

In the Asian session, at GMT0400, the pair is trading at 114.00, with the USD trading 0.11% higher against the JPY from yesterday’s close.

On the macro front, Japan’s machinery orders fell more-than-expected by 8.1% on a monthly basis in September, dropping at its fastest pace in more than two years. Machinery orders had registered a rise of 3.4% in the previous month, while markets had envisaged for a fall of 2.0%.

On the contrary, the nation’s trade surplus (BOP basis) widened to ¥852.2 billion in September, higher than market anticipation for a surplus of ¥832.5 billion. The nation had registered a trade surplus of ¥318.7 billion in the previous month.

Meanwhile, according to the Bank of Japan’s (BoJ) summary of opinions report, policymakers debated calls from one of its board members to target the longer end of the yield curve at its October meeting. Also, officials showed reluctance to loosen monetary conditions further, despite sluggish inflation.

Early morning data indicated that the nation’s Eco-Watchers Survey for the current situation unexpectedly rose to a level of 52.2 in October, confounding market expectations for a fall to a level of 50.8. In the prior month, the index had registered a level of 51.3. Additionally, the nation’s Eco-Watchers Survey for the future outlook climbed to a level of 54.9 in October, higher than market expectations of an advance to a level of 51.5. In the prior month, the index had registered a reading of 51.0.

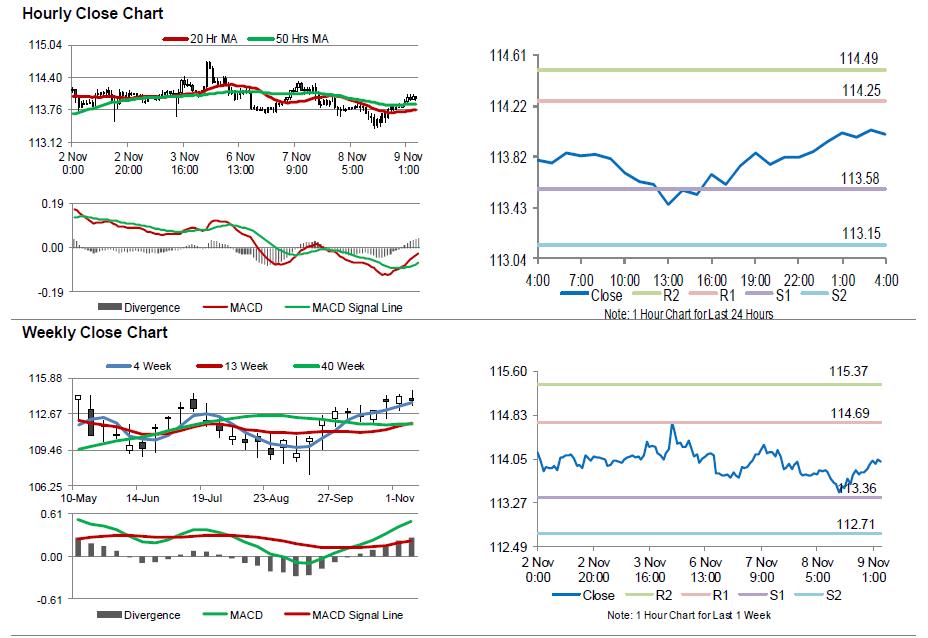

The pair is expected to find support at 113.58, and a fall through could take it to the next support level of 113.15. The pair is expected to find its first resistance at 114.25, and a rise through could take it to the next resistance level of 114.49.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.