For the 24 hours to 23:00 GMT, the USD rose 0.10% against the JPY and closed at 107.94 on Friday.

In the Asian session, at GMT0300, the pair is trading at 107.93, with the USD trading a tad lower against the JPY from Friday’s close.

Overnight data showed that Japan’s retail trade advanced 2.0% on a yearly basis in August, more than market expectations for a rise of 0.9%. In the prior month, retail trade had recorded a fall of 2.0%. Moreover, the nation’s large retailers’ sales unexpectedly climbed 0.4% in August, defying market anticipations for a decline of 1.8%. In the preceding month, large retailers’ sales had recorded a drop of 4.8%.

On the other hand, Japan’s industrial production declined 4.7% on an annual basis in August, more than market consensus for a drop of 1.8%. In the prior month, industrial production had registered a rise of 0.7%.

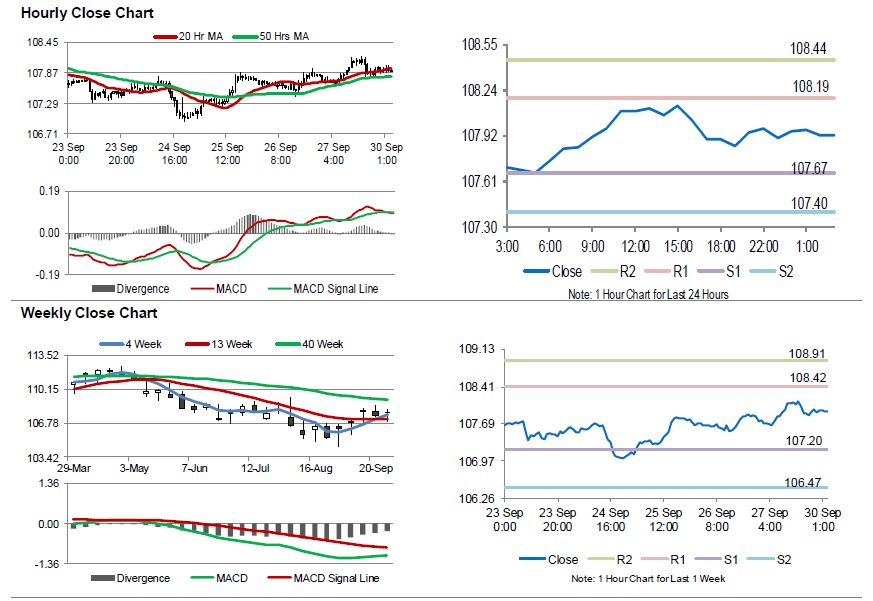

The pair is expected to find support at 107.67, and a fall through could take it to the next support level of 107.40. The pair is expected to find its first resistance at 108.19, and a rise through could take it to the next resistance level of 108.44.

Looking ahead traders would keep an eye on Japan’s unemployment rate for August and Nikkei manufacturing PMI for September, scheduled to release overnight.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.