For the 24 hours to 23:00 GMT, the AUD rose 0.32% against the USD and closed at 0.7100 on Friday.

LME Copper prices rose 1.6% or $100.0/MT to $6485.0/MT. Aluminium prices climbed 0.2% or $3.5/MT to $1900.0/MT.

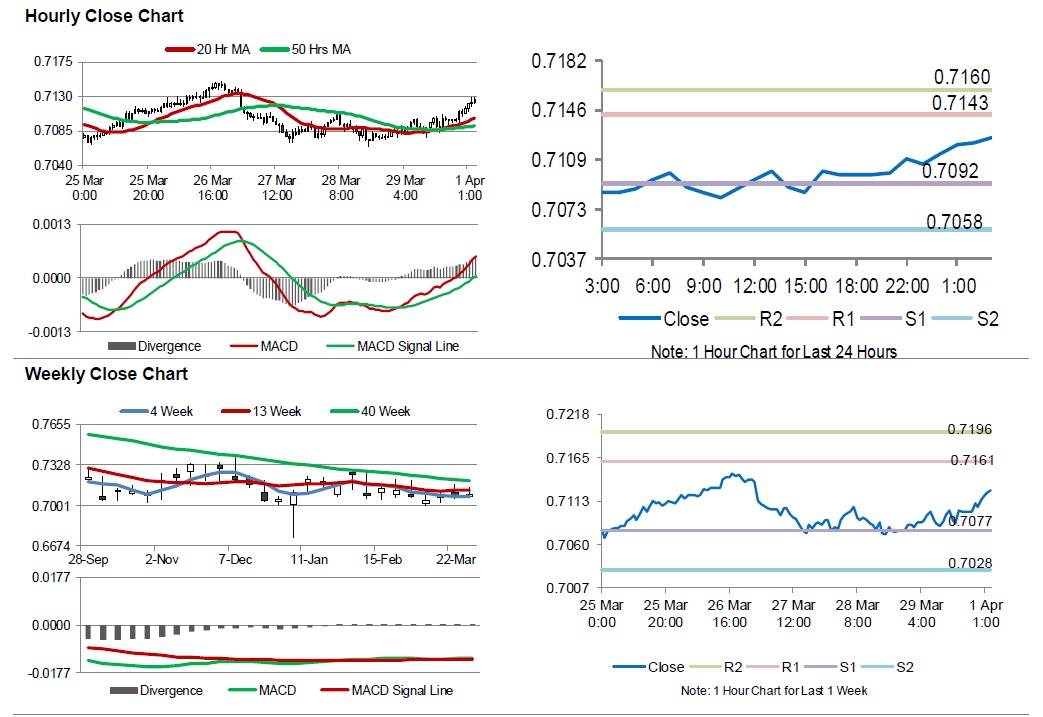

In the Asian session, at GMT0300, the pair is trading at 0.7125, with the AUD trading 0.35% higher against the USD from Friday’s close.

Earlier in the session, data showed that Australia’s AiG performance of manufacturing index declined for the third consecutive month to a level of 51.0 in March, following a reading of 54.0 in the previous month. Meanwhile, the nation’s CBA manufacturing PMI dropped to a level of 52.0 in March, confirming the preliminary print. In the prior month, the PMI had recorded a level of 52.9.

Overnight data indicated that Australia’s NAB business confidence recorded a flat reading in March, compared to a reading of 2.0 in February. Meanwhile, business conditions rose to 7.0 in March, following a reading of 4.0 in the previous month.

The pair is expected to find support at 0.7092, and a fall through could take it to the next support level of 0.7058. The pair is expected to find its first resistance at 0.7143, and a rise through could take it to the next resistance level of 0.7160.

Moving ahead, investors would focus on Australia’s building approvals data for February, slated to release overnight. Additionally, the Reserve Bank of Australia’s interest rate decision, slated to release early morning tomorrow, will garner significant amount of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.