For the 24 hours to 23:00 GMT, the AUD slightly declined against the USD and closed at 0.7201 on Friday.

Yesterday data showed that Australia’s AiG performance of services index dropped to 51.1 in October, compared to a level of 52.5 in the prior month.

LME Copper prices rose 3.1% or $185.0/MT to $6255.0/MT. Aluminium prices rose 0.3% or $6.0/MT to $1967.0/MT.

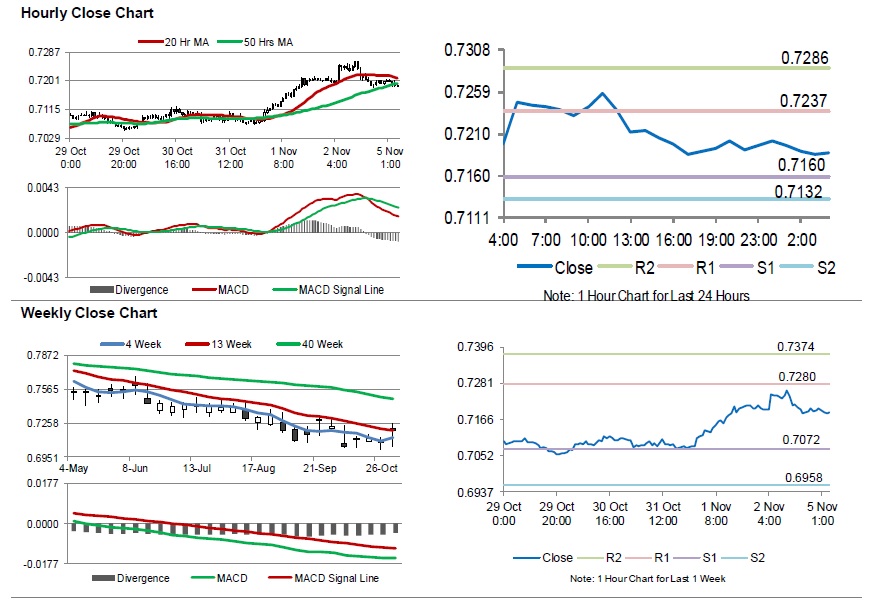

In the Asian session, at GMT0400, the pair is trading at 0.7187, with the AUD trading 0.19% lower against the USD from Friday’s close.

Elsewhere, in China, Australia’s largest trading partner, the Markit services PMI index fell to a level of 50.8 in October, more than market expectations. The Markit services PMI index had registered a level of 53.1 in the previous month.

The pair is expected to find support at 0.7160, and a fall through could take it to the next support level of 0.7132. The pair is expected to find its first resistance at 0.7237, and a rise through could take it to the next resistance level of 0.7286.

Going forward, traders would closely monitor the Reserve Bank of Australia’s interest rate decision, slated to release early morning tomorrow.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.