For the 24 hours to 23:00 GMT, the AUD declined 11.33% against the USD and closed at 0.6122.

LME Copper prices declined 5.8% or $319.5/MT to $5,211.0/MT. Aluminium prices fell 2.2% or $36.5/MT to $1,640.5/MT.

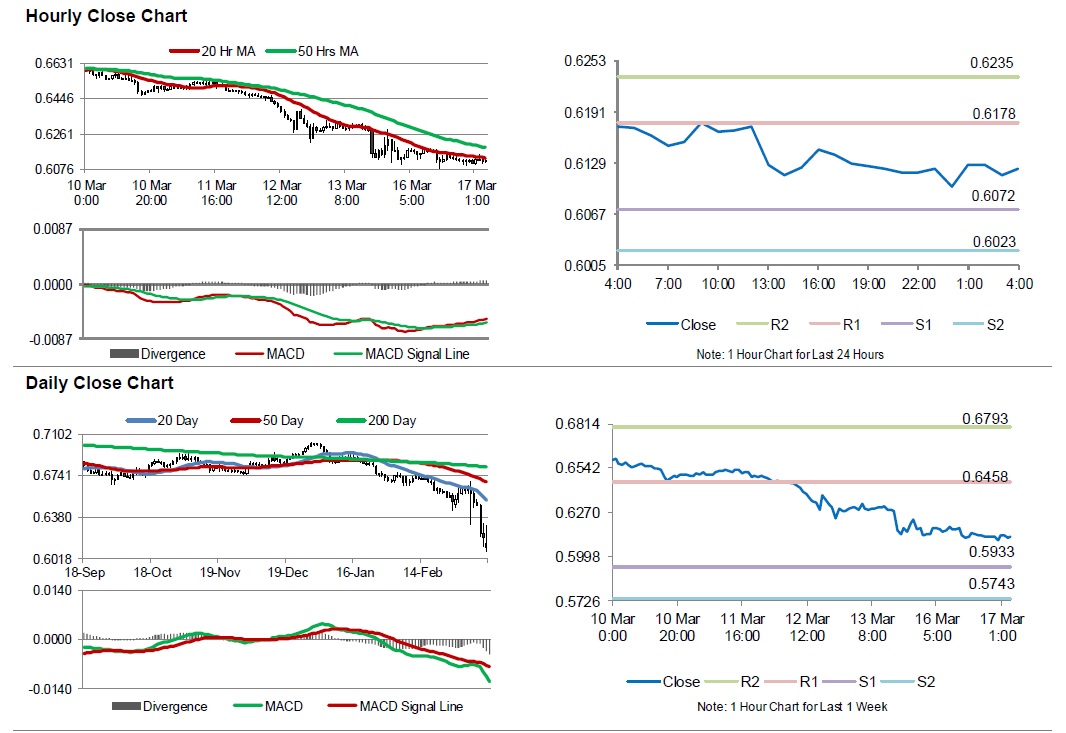

In the Asian session, at GMT0400, the pair is trading at 0.6122, with the AUD trading flat against the USD from yesterday’s close.

Overnight data showed that Australia’s house price index rose 3.9% on a quarterly basis in the fourth quarter of 2019, in line with market forecast and compared to a rise of 2.4% in the previous quarter. On the other hand, the Westpac consumer confidence index dropped to a level of 104.2 in 1Q 2020, compared to a level of 109.9 in the previous quarter.

The Reserve Bank of Australia (RBA), in its latest meeting minutes, revealed that the board is prepared to ease monetary policy further to support Australia’s economy. Moreover, board members suggested that the coronavirus would have significant impact on the country’s national finances and that a near term containment of the virus was considered “very unlikely”. Meanwhile, the central bank expects first quarter growth to be noticeably weaker than previously anticipated.

The pair is expected to find support at 0.6072, and a fall through could take it to the next support level of 0.6023. The pair is expected to find its first resistance at 0.6178, and a rise through could take it to the next resistance level of 0.6235.

Looking forward, participants would keep an eye on Australia’s Westpac leading index for February, slated to release overnight.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.