For the 24 hours to 23:00 GMT, the AUD declined 0.10% against the USD and closed at 0.6730.

LME Copper prices rose 1.2% or $69.0/MT to $5722.0/MT. Aluminium prices declined 0.6% or $10.5/MT to $1713.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.671, with the AUD trading 0.30% lower against the USD from yesterday’s close.

Overnight data showed that Australia’s private sector credit demand advanced 3.1% on a yearly basis in July, undershooting market expectations for a gain of 3.2%. The private sector credit had recorded an increase of 3.3% in the prior month. Meanwhile the nation’s seasonally adjusted building approvals plunged 28.5% on an annual basis in July, higher than market expectations for a fall of 22.2%. Building approvals had recorded a revised drop of 25.0% in the prior month.

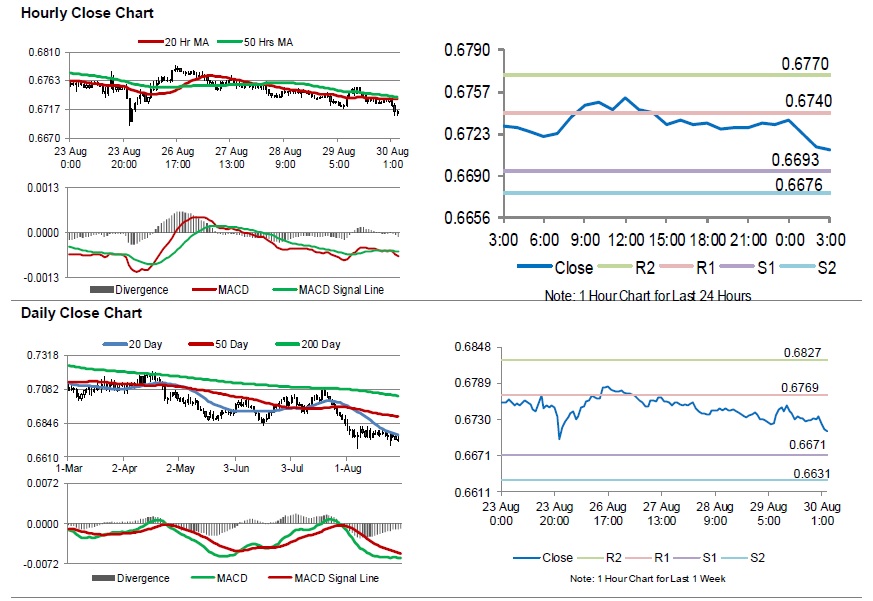

The pair is expected to find support at 0.6693, and a fall through could take it to the next support level of 0.6676. The pair is expected to find its first resistance at 0.6740, and a rise through could take it to the next resistance level of 0.6770.

Amid lack of economic releases in Australia today, traders would focus on global macroeconomic events for further direction.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.