For the 24 hours to 23:00 GMT, the AUD declined 5.19% against the USD and closed at 0.6546.

LME Copper prices rose 0.3% or $14.5/MT to $5,184.0/MT. Aluminium prices declined 0.1% or $1.0/MT to $1,464.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.6538, with the AUD trading 0.12% lower against the USD from yesterday’s close.

Overnight data showed that Australia’s private sector credit demand rose 1.1% on a monthly basis in March, compared to a rise of 0.4% in the prior month.

Elsewhere in China, Australia’s largest trading partner, the non-manufacturing PMI climbed to 53.2 in April, compared to a level of 52.3 in the previous month. Meanwhile, the NBS manufacturing PMI fell 50.8 in April, more than market forecast for a drop to a level of 51.0 and compared to a reading of 52.0 in the earlier month. Moreover, the manufacturing PMI slid to a level of 49.4 in April, compared to 50.1 in the previous month.

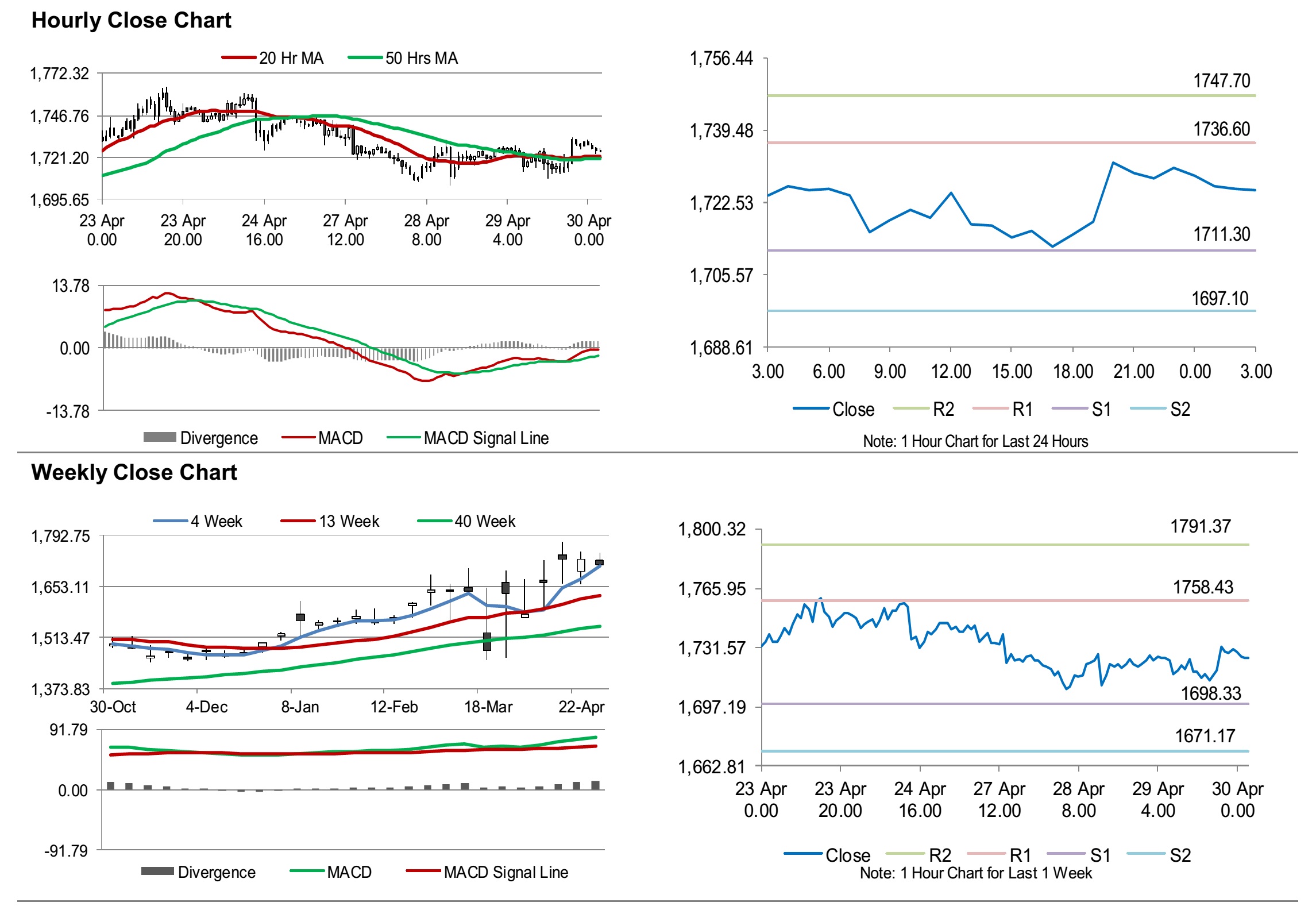

The pair is expected to find support at 0.6510, and a fall through could take it to the next support level of 0.6481. The pair is expected to find its first resistance at 0.6563, and a rise through could take it to the next resistance level of 0.6587.

Looking ahead, investors would keep a watch on Australia’s AiG performance of manufacturing index and the Commonwealth Bank manufacturing PMI, both for April, along with the producer price index for 1Q2020, slated to release overnight.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.