For the 24 hours to 23:00 GMT, the AUD weakened 0.45% against the USD to close at 0.7465.

LME Copper prices declined 1.37% or $68.0 /MT to $4892.0 /MT. Aluminium prices declined 1.10% or $18.0 /MT to $1611.0 /MT.

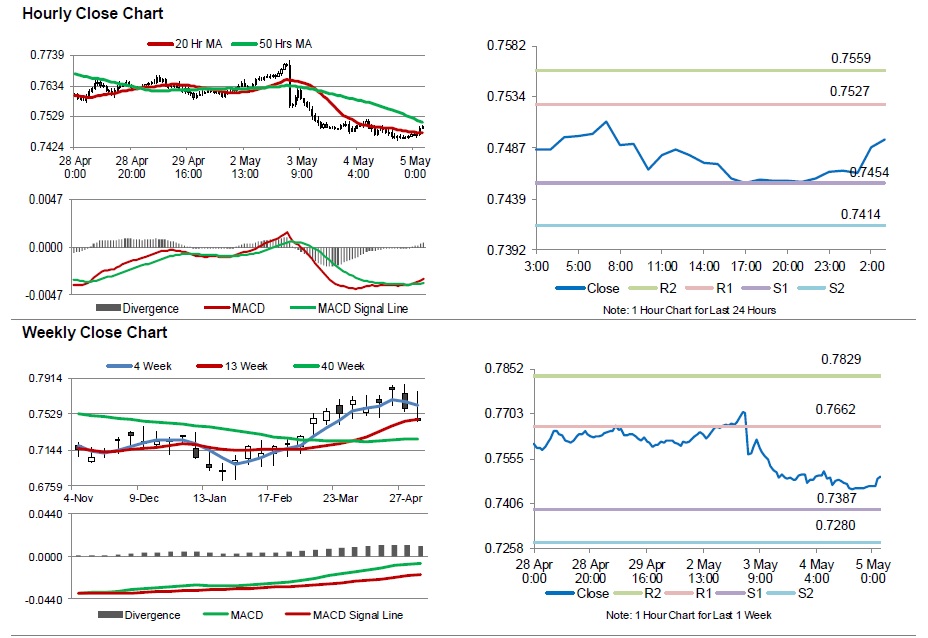

In the Asian session, at GMT0300, the pair is trading at 0.7495, with the AUD trading 0.4% higher from yesterday’s close.

Early this morning, data showed that Australia’s new home sales surged by 8.9% MoM in March, its largest increase since January 2010. In the prior month, new home sales had recorded a drop of 5.3%. Additionally, the nation’s seasonally adjusted retail sales advanced above expectations by 0.4% MoM in March, indicating robust consumer confidence. Investors had expected a rise of 0.3%, following a revised increase of 0.1% in the previous month. Moreover, Australia’s trade deficit narrowed to a one-year low level of A$2163.0 million, following a revised trade deficit of A$3044.0 million in the previous month. Markets were expecting the nation to register a trade deficit of A$2900.0 million. Meanwhile, the nation’s exports rebounded 4.0%, while imports edged up by 1.0% in March.

Elsewhere, in China, Australia’s largest trading partner, the Caixin services PMI dropped to a level of 51.8 in April, following a reading of 52.2 in the previous month.

The pair is expected to find support at 0.7454, and a fall through could take it to the next support level of 0.7414. The pair is expected to find its first resistance at 0.7527, and a rise through could take it to the next resistance level of 0.7559.

Moving ahead, investors will look forward to Australia’s AiG performance of construction index for April, scheduled to release overnight.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.