For the 24 hours to 23:00 GMT, the AUD declined 0.07% against the USD and closed at 0.76.

LME Copper prices rose 1.1% or $73.0/MT to $6807.0/MT. Aluminium prices rose 0.3% or $6.0/MT to $2052.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7644, with the AUD trading 0.58% higher against the USD from yesterday’s close, after Australia’s retail sales rebounded in October, notching its highest level in five months.

Earlier today, the Reserve Bank of Australia (RBA), as widely expected, kept its key interest rate steady at 1.5%, citing soft wage growth and a lack of inflationary pressure. In a post meeting statement, Governor Philip Lowe, stated that the Australian economy likely grew at around its “trend rate” over the year to the third quarter and expressed optimism about future growth prospects. Further, the central bank stuck to its forecast for inflation to “pick up gradually as the economy strengthens”.

On the data front, Australia’s AiG performance of services index climbed to a level of 51.7 in November, compared to a reading of 51.4 in the prior month. Moreover, the nation’s seasonally adjusted retail sales rose more-than-expected by 0.5% on a monthly basis in October, easing concerns over a slowdown in consumer spending in recent months. In the prior month, retail sales had climbed by a revised 0.1%, while markets had anticipated for a gain of 0.3%.

Elsewhere, in China, Australia’s largest trading partner, the Caixin services PMI climbed to a three-month high level of 51.9 in November, amid a pick-up in new business. In the previous month, the PMI index had registered a level of 51.2.

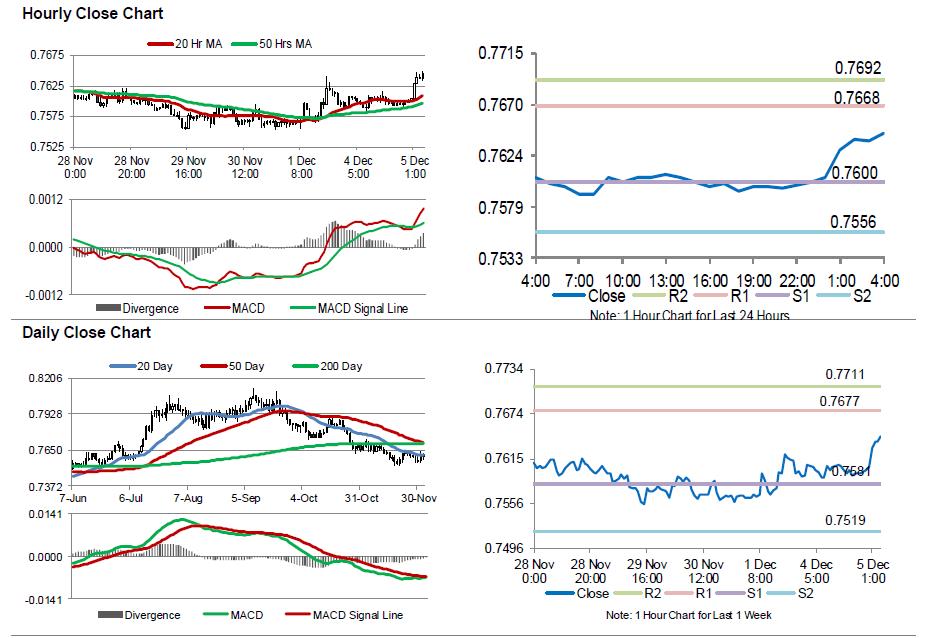

The pair is expected to find support at 0.7600, and a fall through could take it to the next support level of 0.7556. The pair is expected to find its first resistance at 0.7668, and a rise through could take it to the next resistance level of 0.7692.

Going ahead, investors would keep a close watch on Australia’s 3Q GDP data, scheduled to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.