For the 24 hours to 23:00 GMT, the AUD strengthened 0.07% against the USD to close at 0.7470.

LME Copper prices declined 1.35% or $66.0 /MT to $4826.0 /MT. Aluminium prices declined 0.59% or $9.5 /MT to $1601.5 /MT.

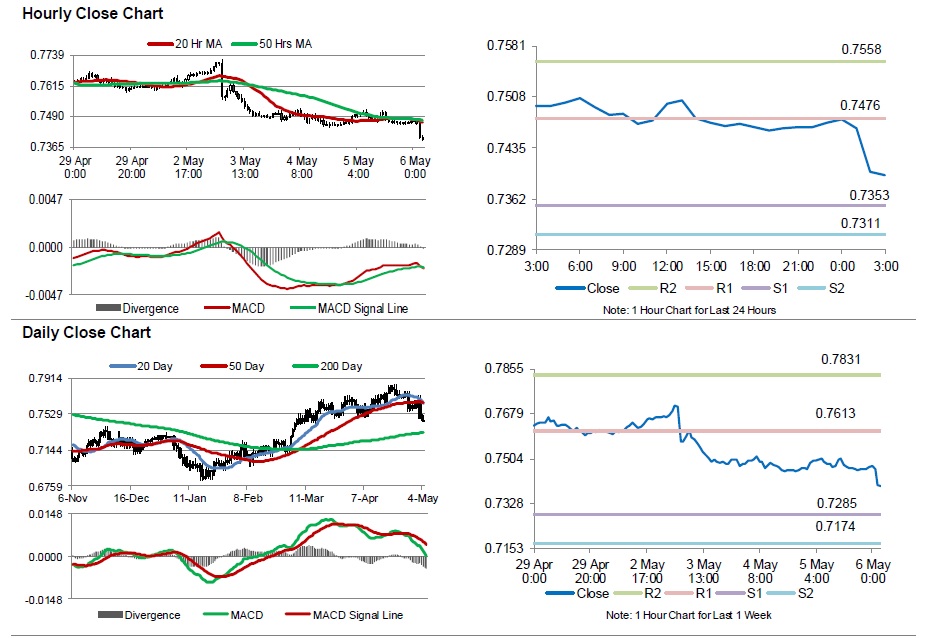

In the Asian session, at GMT0300, the pair is trading at 0.7395, with the AUD trading 1.01% lower from yesterday’s close.

Overnight data showed that Australia’s AiG performance of construction index advanced to a level of 50.8 in April, from a reading of 45.2 in the previous month.

Early this morning, the Reserve Bank of Australia (RBA) in its monetary policy statement, revised lower its forecast for underlying inflation in Australia to 1-2% in 2016, down from its previous 2-3% prediction, mainly due to lower-than-expected outcome for inflation in the March quarter and an expectation that domestic cost pressures, including labour costs, will pick up more gradually than anticipated. Meanwhile, the central bank kept its 2016 GDP growth forecast unchanged at 2.5-3.5%. Further, the central bank will continue to assess the outlook and adjust policy as needed to foster sustainable growth in the nation.

The pair is expected to find support at 0.7353, and a fall through could take it to the next support level of 0.7311. The pair is expected to find its first resistance at 0.7476, and a rise through could take it to the next resistance level of 0.7558.

Moving ahead, market participants will look forward to Australia’s home loans and consumer inflation expectations data, scheduled to release next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.