For the 24 hours to 23:00 GMT, the AUD declined 0.66% against the USD and closed at 0.7776, after the Reserve Bank of Australia’s (RBA) Governor, Philip Lowe, diminished the odds of an imminent interest rate hike, on the backdrop of sluggish wage growth and scant inflationary pressures. Nevertheless, Lowe expressed confidence that a pick-up in economic growth would gradually fuel inflation and reduce unemployment.

LME Copper prices declined 2.4% or $168.0/MT to $6838.0/MT. Aluminium prices declined 0.6% or $13.5/MT to $2168.0/MT.

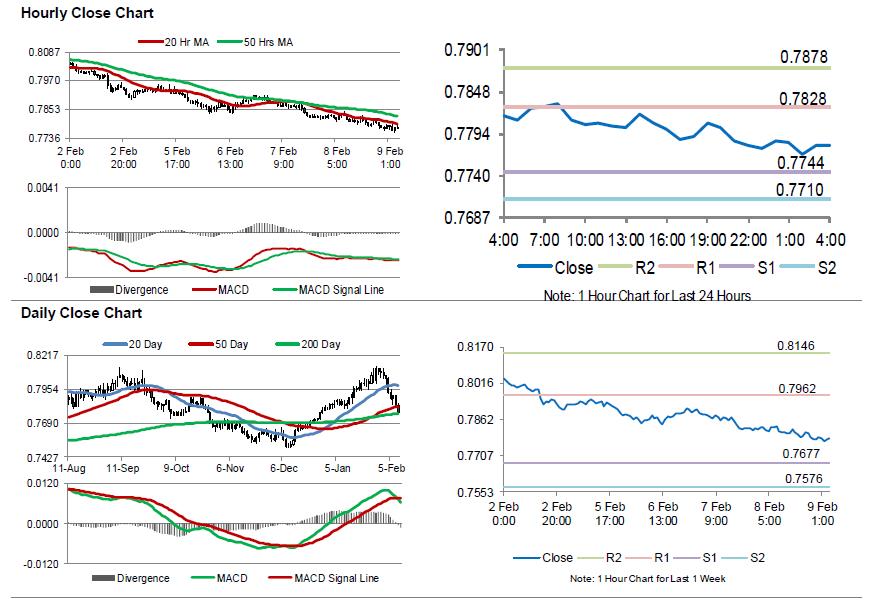

In the Asian session, at GMT0400, the pair is trading at 0.7779, with the AUD trading slightly higher against the USD from yesterday’s close.

Overnight, the Reserve Bank of Australia (RBA), in its quarterly statement on monetary policy, stated that it continues to anticipate Australian economic growth to slightly pick-up over the next two years. Further, the central bank added that unemployment will decline faster than expected and that inflation will remain below its 2.00%-3.00% target range until the middle of next year. Additionally, the jobless rate is estimated to slip to 5.25% by mid-2018 and remain there until 2020.

Elsewhere in China, Australia’s largest trading partner, the consumer price index (CPI) rose 1.5% on an annual basis in January, at par with market expectations and rising at its weakest pace in 7 months. In the prior month, the CPI had advanced 1.8%. Further, the nation’s producer price index (PPI) grew 4.3% YoY in January, meeting market anticipations. In the prior month, the PPI had gained 4.9%.

The pair is expected to find support at 0.7744, and a fall through could take it to the next support level of 0.7710. The pair is expected to find its first resistance at 0.7828, and a rise through could take it to the next resistance level of 0.7878.

Moving ahead, Australia’s unemployment rate, consumer inflation expectations, NAB business confidence and Westpac consumer confidence indices, all slated to release next week, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.