For the 24 hours to 23:00 GMT, the AUD rose 0.16% against the USD and closed at 0.6892.

LME Copper prices rose 0.5% or $27.5/MT to $5941.0/MT. Aluminium prices remained unchanged at $1817.5/MT.

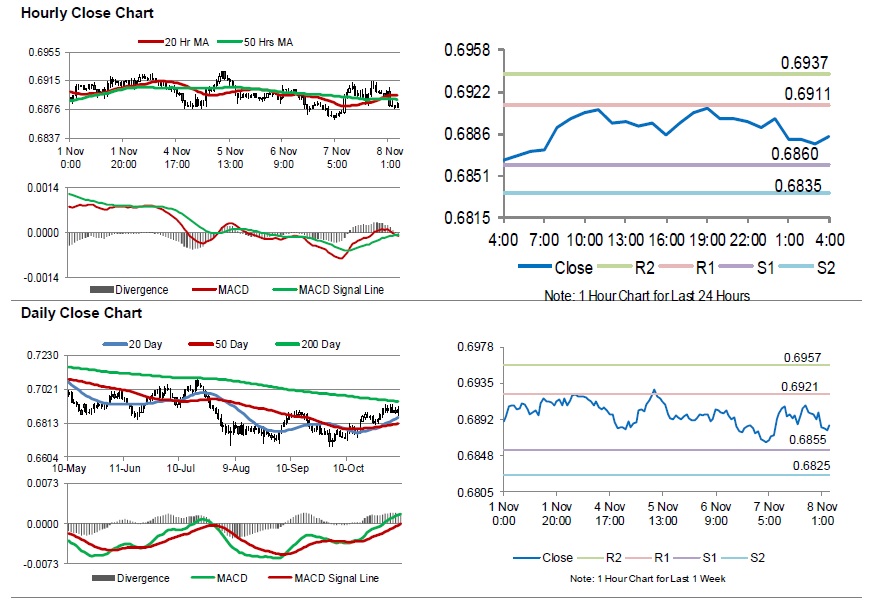

In the Asian session, at GMT0400, the pair is trading at 0.6884, with the AUD trading 0.12% lower against the USD from yesterday’s close.

The Reserve Bank of Australia, in its latest monetary policy statement, revealed that the Australian economy was ‘gradually coming out of a soft patch’. The central bank highlighted concerns that it is running out of room to cut interest rates further and warned that additional rate cuts might backfire by affecting consumer sentiment. Further, the RBA forecasted a subdued wage growth of just 2.3% up to the end of 2021.

Data indicated that Australia’s seasonally adjusted home loan approvals advanced 3.6% on a monthly basis in September. Home loan approvals had advanced by a revised 2.0% in the previous month. Elsewhere, in China, trade surplus widened more-than-expected to $2.81 billion in October, compared to a surplus of $39.65bn in the previous month.

The pair is expected to find support at 0.6860, and a fall through could take it to the next support level of 0.6835. The pair is expected to find its first resistance at 0.6911, and a rise through could take it to the next resistance level of 0.6937.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.