For the 24 hours to 23:00 GMT, the EUR declined 0.31% against the USD and closed at 1.1600 on Friday, after the Catalan Parliament declared its independence from Spain.

The European Central Bank’s (ECB) survey of professional forecasters showed that the Eurozone consumer price index could be higher than earlier expected in five years’ time, thus supporting the ECB’s recent decision to trim its monetary stimulus. Inflation growth is expected to rise to 1.9% by 2022, in line with the central bank’s target and above the 1.8% projected three months ago. Moreover, the Eurozone economy is also expected to grow at a faster rate than previously expected for both 2018 and 2019. The survey now anticipates growth at 1.9% and 1.7% in 2018 and 2019, respectively.

On the macro front, German import price index advanced more than expected on a yearly basis in September as it registered a rise of 3.0%, compared to a rise of 2.1% in the previous month. Market anticipation was for the import price index to climb 2.6%.

The US Dollar gained ground against its major counterparts after macroeconomic data showed that the world’s largest economy expanded at an annual rate of 3.0% on a QoQ basis in the third quarter of 2017, compared to a rise of 3.1% in the prior quarter. Market had anticipated the annualised GDP growth to ease to 2.6% due to devastation caused by Hurricanes Harvey and Irma. Additionally, the final Reuters/Michigan consumer sentiment index in the US rose to 100.7 in October, at par with market expectations. In the prior month, the consumer sentiment index had recorded a reading of 95.1. The preliminary figures had indicated an advance to 98.0. However, gains in the US dollar were pared following news that US President, Donald Trump, was leaning toward Federal Reserve Governor, Jerome Powell, as the next US central bank Chairman.

In the Asian session, at GMT0400, the pair is trading at 1.1614, with the EUR trading 0.12% higher from Friday’s close.

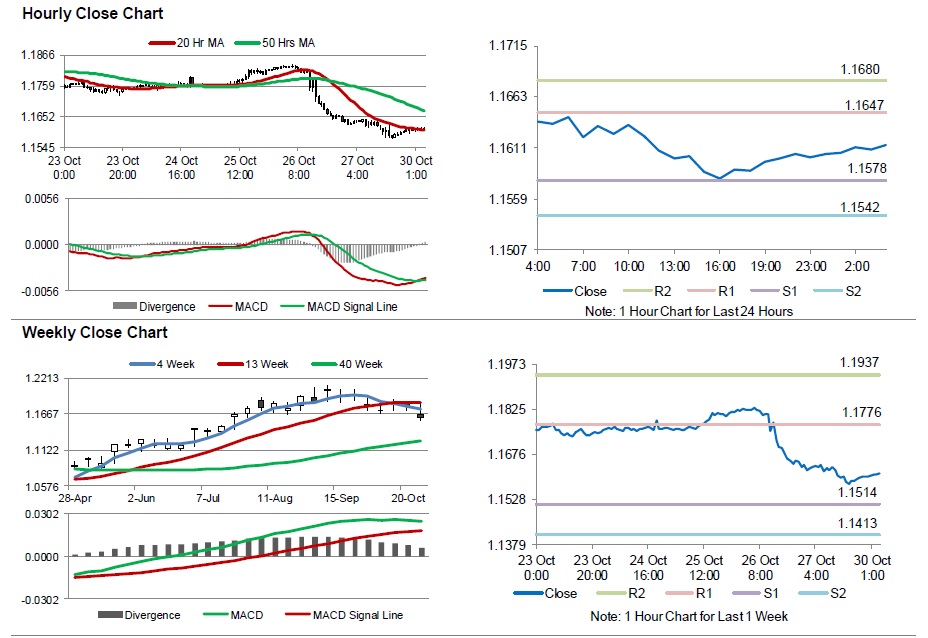

The pair is expected to find support at 1.1578, and a fall through could take it to the next support level of 1.1542. The pair is expected to find its first resistance at 1.1647, and a rise through could take it to the next resistance level of 1.1680.

Moving ahead, all eyes will be on the Eurozone economic confidence and business climate indicator, along with the region’s final consumer confidence index, all for October, due to release today. Moreover, Germany’s inflation numbers for October and the nation’s retail sales data for September, scheduled for today, will be on investors’ radar. In the US, personal spending as well as income figures for September, set to release later in the day, will also garner significant market attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.