For the 24 hours to 23:00 GMT, the EUR declined 0.52% against the USD and closed at 1.1675.

The European Central Bank (ECB) President, Mario Draghi stated that the improvement in the euro-area inflation is on a self-sustained path and expressed confidence over the bank’s decision to withdraw its stimulus, despite rising global trade tensions. Additionally, Draghi stressed the requirement for a common deposit insurance mechanism across Eurozone retail banks in order to safeguard the financial system.

In the US, data indicated that the US producer price index (PPI) advanced 3.4% on a yearly basis in June, compared to a rise of 3.1% in the previous month. Market participants had envisaged the PPI to record a steady reading. Meanwhile, the MBA mortgage applications climbed 2.5% on a weekly basis in the week ended 06 July. In the prior week, mortgage applications had recorded a drop of 0.5%.

In the Asian session, at GMT0300, the pair is trading at 1.1674, with the EUR trading slightly lower against the USD from yesterday’s close.

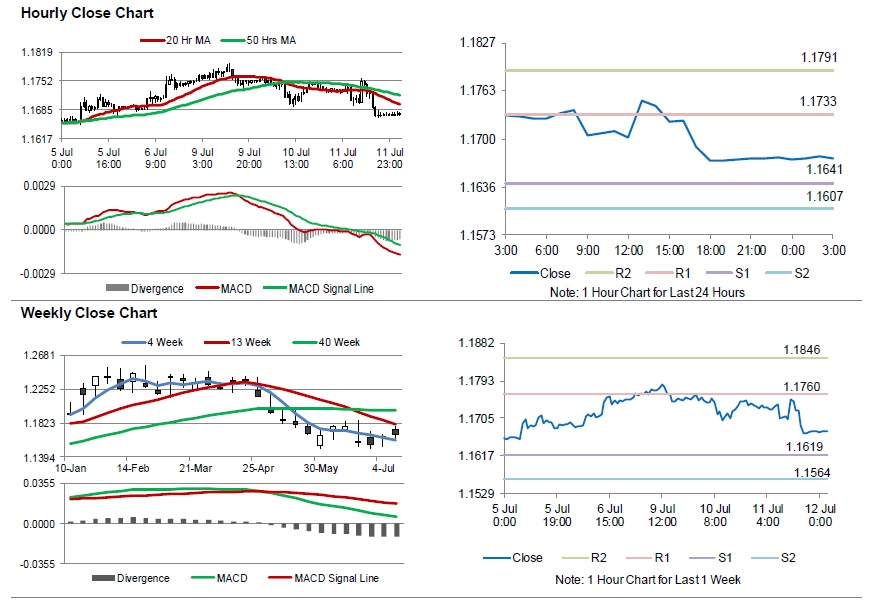

The pair is expected to find support at 1.1641, and a fall through could take it to the next support level of 1.1607. The pair is expected to find its first resistance at 1.1733, and a rise through could take it to the next resistance level of 1.1791.

Going ahead, investors would await the Euro-zone’s industrial production for May and Germany’s final consumer price index for June, set to release in a few hours. Later in the day, the US initial jobless claims followed by the consumer price index and average hourly earnings, both for June, will garner significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.