For the 24 hours to 23:00 GMT, the EUR declined 0.72% against the USD and closed at 1.1301, after the European Central Bank’s (ECB) Chief, Mario Draghi warned of downside risks to the Euro-zone’s economy and cautioned that near term growth would be weaker than expected.

In economic news, Euro-zone’s manufacturing PMI dropped to a level of 50.5 in January, hitting its lowest level in 50 months and more than market expectations for a fall to a level of 51.3. In the prior month, the index had registered a reading of 51.4. Moreover, the region’s Markit services PMI unexpectedly fell to a 65-month low level of 50.8 in January, defying market expectations for a rise to a level of 51.5. The services PMI had recorded a level of 51.2 in the previous month. Separately, in Germany, the Markit manufacturing PMI declined to 49.9 in January, notching its lowest level in 50 months. In the previous month, the index had registered a level of 51.5, while investors had envisaged for a fall to a level of 0.2%. On the contrary, the nation’s services PMI climbed to a level of 53.1 in January, beating market anticipations for a rise to a level of 52.2 and compared to a reading of 51.8 in the previous month.

In major news, the ECB, in latest policy meeting, kept its benchmark interest rate unchanged at 0.0%, as widely expected. Additionally, the central bank signalled that it expects the key interest rates to remain at their present levels at least through the summer of 2019. Nevertheless, some economists expect the central bank to raise interest rates only in 2020, citing weak inflation & growth outlook and persistent geopolitical tensions.

In a statement, following the meeting, ECB President, Mario Draghi, warned of rise in downside risks to the Euro-zone’s economic growth, due to financial market volatility and continuing global trade tensions. Further, he cautioned that near-term growth momentum was likely to be weaker-than-expected.

In the US, data showed that the preliminary Markit manufacturing PMI unexpectedly rose to 54.9 in January, confounding market expectations for a fall to a level of 53.5. In the prior month, the Markit manufacturing PMI had registered a reading of 53.8. Additionally, seasonally adjusted initial jobless claims unexpectedly fell to a 50-year low level of 199.0K in the week ended 19 January 2019. In the prior week, initial jobless claims had registered a revised level of 212.0K, while investors had envisaged for a rise to a level of 218.0K. Meanwhile, the preliminary Markit services PMI dropped less-than-expected to 54.2 in January. The Markit services PMI had registered a level of 54.4 in the previous month. Moreover, the leading index slid 0.1% on a monthly basis in December, at par with market expectations. In the prior month, the index had recorded a rise of 0.2%.

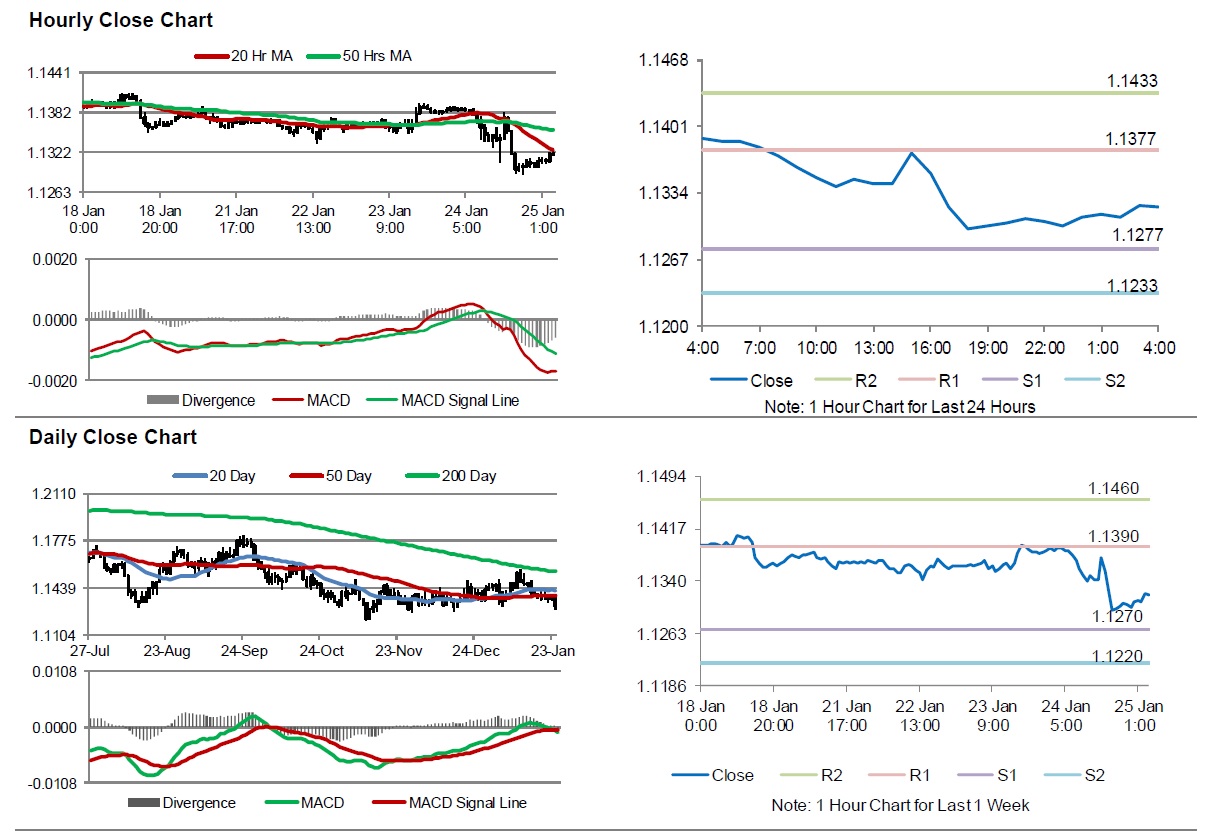

In the Asian session, at GMT0400, the pair is trading at 1.1320, with the EUR trading 0.17% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1277, and a fall through could take it to the next support level of 1.1233. The pair is expected to find its first resistance at 1.1377, and a rise through could take it to the next resistance level of 1.1433.

Moving ahead, investors would look forward to Germany’s Ifo survey indices for January, scheduled to release in a few hours. Moreover, the US monthly budget statement for December, set to release later in the day, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.