For the 24 hours to 23:00 GMT, the EUR declined 1.34% against the USD and closed at 1.0613, after the European Central Bank (ECB) signalled that it would extend its quantitative-easing (QE) programme by an extra nine months or beyond, if necessary.

The ECB, in its latest monetary policy meeting, opted to leave the key interest rate unchanged at 0.0%, but surprised investors by announcing that it will scale back its asset purchase programme to €60.0 billion per month from €80.0 billion, starting from April 2017 through December 2017.

In the US, the number of American filing for fresh jobless benefits fell to a level of 258.0K in the week ended 03 December 2016, meeting market expectations, thus pointing towards a healthy labour market. Initial jobless claims recorded a level of 268.0K in the prior week.

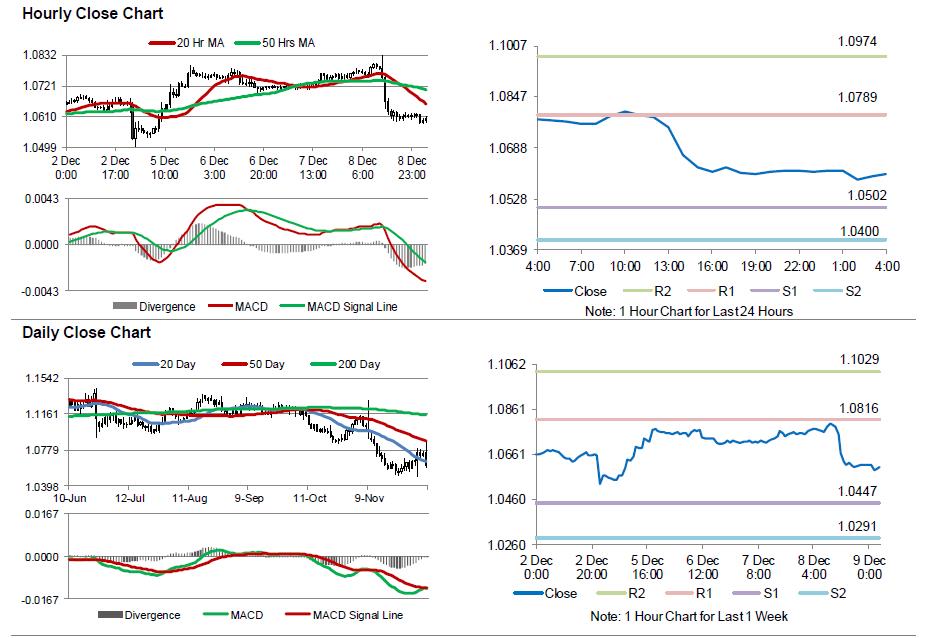

In the Asian session, at GMT0400, the pair is trading at 1.0604, with the EUR trading 0.08% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0502, and a fall through could take it to the next support level of 1.0400. The pair is expected to find its first resistance at 1.0789, and a rise through could take it to the next resistance level of 1.0974.

Moving ahead, market participants will look forward to Germany’s trade balance figures, slated to release in a few hours. Additionally, the US flash Michigan consumer confidence index, due to release later today, will attract significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.