For the 24 hours to 23:00 GMT, the EUR declined 0.27% against the USD and closed at 1.1384.

On the macro front, Euro-zone’s trade surplus widened to £8.0 billion in May, amid easing of coronavirus-led lockdown restrictions and compared to a revised surplus of £1.6 billion in the prior month.

The European Central Bank (ECB), in its interest decision, kept its key interest rate unchanged at 0%, as widely expected and pledged not to raise interest rate until progress is made. In addition, the central bank also maintained its purchases under the pandemic emergency purchase programme (PEPP) with a total envelope of €1,350 billion, or until the bank believes the crisis is over. Moreover, it expects rates to remain at their “present or lower” levels until it has seen the inflation outlook “robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.”

In the US, the Philadelphia Fed manufacturing survey dropped to 24.1 in July, less than market expectations for a drop to a level of 20.0 and compared to a reading of 27.5 in the previous month. Additionally, the NAHB housing market index jumped to 72.0 in July, more than market expectations for a rise to a level of 60.0 and compared to a reading of 58.0 in the prior month. Moreover, advance retail sales climbed 7.5% on a monthly basis in June, more than market forecast and compared to a revised advance of 18.2% in the prior month. Meanwhile, initial jobless claims fell to 1300.0K in the week ended 10 July 2020, less than market expectations for fall to level of 1250.0K and compared to a revised reading of 1310.0K in the prior month. Further, business inventories fell 2.3% in May, in line with market forecast and compared to a revised fall of 1.4% in the earlier month.

In the Asian session, at GMT0300, the pair is trading at 1.1385, with the EUR trading marginally higher against the USD from yesterday’s close.

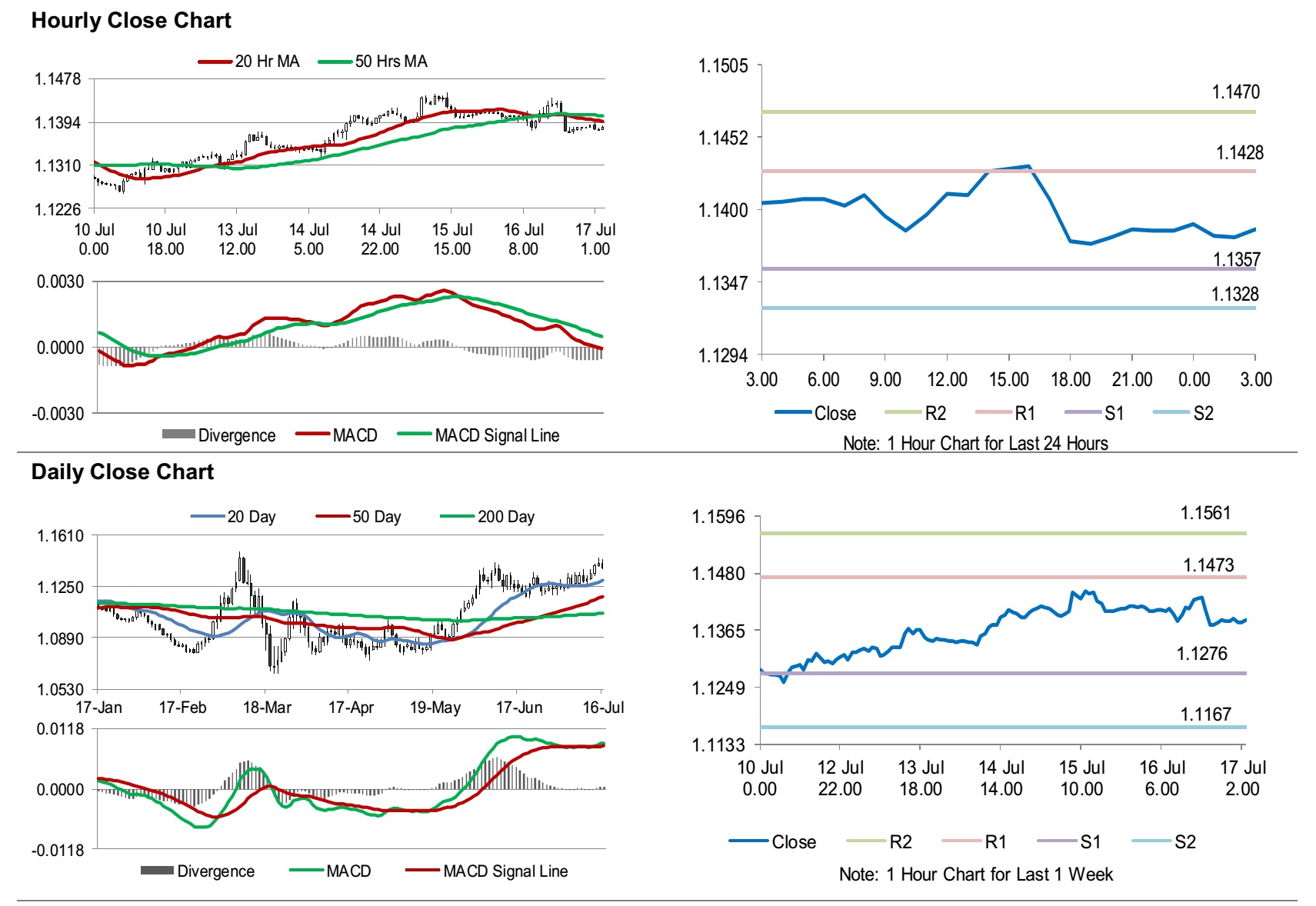

The pair is expected to find support at 1.1357, and a fall through could take it to the next support level of 1.1328. The pair is expected to find its first resistance at 1.1428, and a rise through could take it to the next resistance level of 1.1470.

Going forward, traders would keep a watch on Euro-zone’s consumer price index for June and construction output for May, slated to release in a few hours. Later in the day, the US building permits and housing starts, both for June along with the Michigan consumer sentiment index for July, would keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.