For the 24 hours to 23:00 GMT, the EUR rose 0.22% against the USD and closed at 1.0656, after the European Central Bank (ECB) held the key interest rate steady as widely expected.

The ECB, in its first policy meeting of the year, left the benchmark interest rates at record low level of 0.00% and maintained its unprecedented stimulus in place to shore-up the Euro-bloc’s slow but steady recovery. In a press conference accompanied with the meeting, the ECB President, Mario Draghi, stated that inflation in the common currency region is being primarily driven by higher energy costs and the recent pick-up in momentum is unlikely to sustain. Further, he added that risks to the region’s growth outlook remains tilted to downside due to global factors. The ECB Chief also reiterated that the central bank continues to expect its key interest rates to remain at present or lower levels for an extended period of time and well past the horizon of the net asset purchases if the outlook becomes less favourable. Commenting on the Brexit issue, Draghi stated that it was too early to assess what impact Britain’s planned exit from the European Union and its single market would have.

On the data front, the Euro-zone’s seasonally adjusted current account surplus widened to €36.1 billion in November, from a revised current account surplus of €28.3 billion in the previous month.

The US Dollar gained ground against a basket of major currencies, after the US housing starts rebounded sharply and weekly initial jobless claims registered an unexpected drop, thus brightening prospects over the health of the nation’s economy.

Data showed that the US initial jobless claims dipped to a 43-year low, after it unexpectedly fell to a level of 234.0K in the week ended 14 January 2017, confounding market expectations of a rise to a level of 252.0K and compared to a revised reading of 249.0K in the previous week. Further, the nation’s housing starts rebounded 11.3% MoM, to an annual rate of 1226.0K in December, compared to market expectations of 1188.0K. In the previous month, housing starts had recorded a revised level of 1102.0K. Additionally, the nation’s Philadelphia Fed manufacturing index surprisingly rose to a level of 23.6 in January, strengthening to its highest level since November 2014 and defying market consensus for a drop to a level of 15.3. In the previous month, the index had recorded a revised reading of 19.7. On the contrary, the nation’s building permits surprisingly eased 0.2% on a monthly basis, to an annual rate of 1210.0K in December, compared to a revised level of 1212.0K in the previous month. Market anticipation was for building permits to rise to 1225.0K.

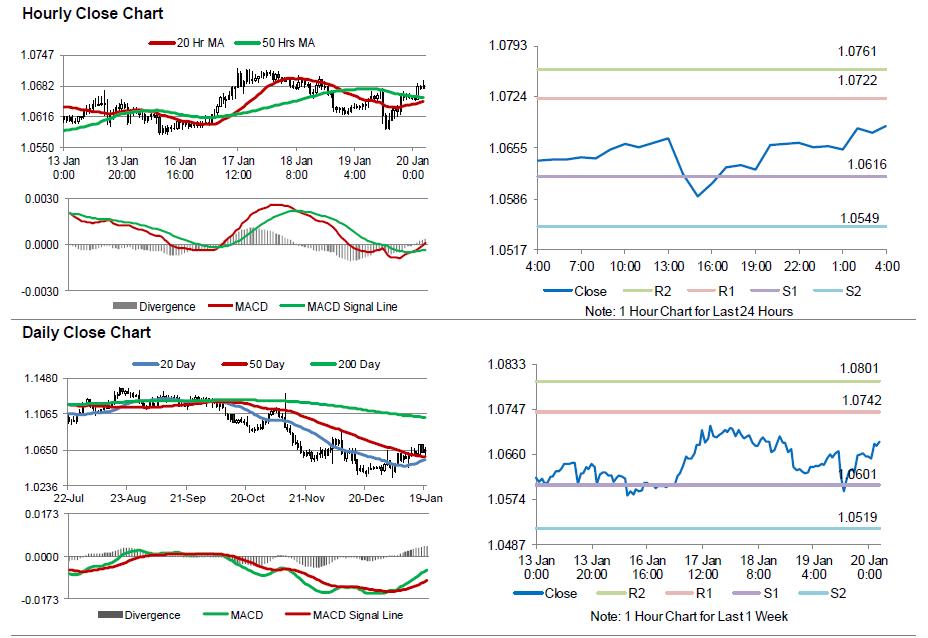

In the Asian session, at GMT0400, the pair is trading at 1.0684, with the EUR trading 0.26% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0616, and a fall through could take it to the next support level of 1.0549. The pair is expected to find its first resistance at 1.0722, and a rise through could take it to the next resistance level of 1.0761.

Ahead in the day, market participants will look forward to Germany’s producer price index for December, scheduled to release in a few hours. Additionally, the US President-elect Donald Trump’s inauguration, slated later in the day, will be eyed by traders.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.