For the 24 hours to 23:00 GMT, the EUR declined 0.52% against the USD and closed at 1.1199, after the European Central Bank (ECB) trimmed its inflation forecasts for the next three years.

The ECB, at its latest monetary policy meeting, maintained the benchmark interest rate steady at 0.00%, as widely expected. In a post meeting statement, the ECB President, Mario Draghi reiterated that the ECB would continue to pump stimulus into the region’s economy and that the central bank could increase the size or duration of its quantitative easing programme if needed. Further, the ECB, reduced its forecast for inflation this year to 1.5%, down from 1.7% predicted in March, while the forecast for 2018 and 2019 was cut to 1.3% and 1.6% respectively as against 1.6% and 1.7% estimated earlier. Nevertheless, the central bank slightly raised its growth projection for the next few years, now expecting the region’s economy to expand 1.9% this year, 1.8% in 2018 and 1.7% in 2019, citing stronger growth momentum in the region.

On the economic front, the Euro-zone’s seasonally adjusted final gross domestic product (GDP) was revised higher to 0.6% on a quarterly basis in the first quarter of 2017, pushing the region’s economic growth to its fastest pace in two years. In the previous quarter, GDP had risen by a revised 0.5%, while the preliminary print indicated an expansion of 0.5%.

Separately, Germany’s seasonally adjusted industrial production rebounded more-than-expected by 0.8% on a monthly basis in April, painting a fairly bright picture of the health of the nation’s industrial sector. Industrial production had recorded a revised drop of 0.1% in the prior month, while markets were expecting for a gain of 0.5%.

The greenback gained ground against a basket of currencies, as investors found that the testimony of former FBI Director, James Comey, had no major surprises that could affect Donald Trump’s Presidency.

The US Dollar added to gains after data revealed that initial jobless claims in the US dropped to a level of 245.0K in the week ended 03 June 2017, pointing to a tighter labour market despite a recent slowdown in job growth. In the previous week, initial jobless claims had registered a revised level of 255.0K, while markets anticipated for a fall to a level of 240.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1195, with the EUR trading marginally lower against the USD from yesterday’s close.

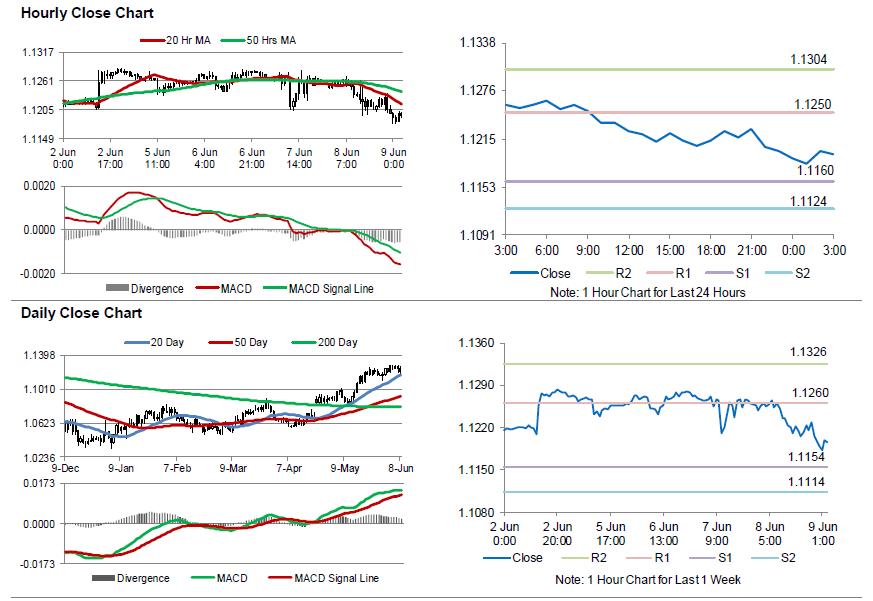

The pair is expected to find support at 1.1160, and a fall through could take it to the next support level of 1.1124. The pair is expected to find its first resistance at 1.1250, and a rise through could take it to the next resistance level of 1.1304.

Moving ahead, investors will look forward to Germany’s trade balance figures for April, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.