For the 24 hours to 23:00 GMT, the EUR rose 0.62% against the USD and closed at 1.1421, after minutes of the European Central Bank (ECB) June meeting indicated that policymakers are tilting towards tapering the central bank’s quantitative easing programme.

According to minutes, board members mulled over the possibility of tapering the ECB’s asset purchases in coming months if confidence in the region’s inflation outlook improves further. However, officials decided against it for now as recovery in the Euro-bloc’s economic activity had yet to result in higher inflation. Moreover, the ECB stressed on the need to maintain caution in communication as it could trigger unwarranted movements in financial markets.

In other economic news, data showed that Germany’s seasonally adjusted factory orders rebounded 1.0% on a monthly basis in May, undershooting market expectations for a rise of 1.9%. In the prior month, factory orders had registered a revised drop of 2.2%. Meanwhile, the nation’s Markit construction PMI fell to a level of 55.1 in June, compared to a reading of 55.3 in the previous month.

The greenback lost ground against its major counterparts, on the back of softer than expected jobs data in the US that pointed to some loss of momentum in the nation’s job growth.

Data revealed that the ADP private sector employment in the US climbed less-than-expected by 158.0K in June, compared to market consensus for a rise of 188.0K. The private sector employment had recorded a revised increase of 230.0K in the previous month. Further, the nation’s initial jobless claims registered an unexpected rise to a level of 248.0K in the week ended 01 July 2017, rising for the third straight week and confounding market expectations of a drop to a level of 243.0K. Initial jobless claims had registered a level of 244.0K in the previous week. Also, the nation’s trade deficit narrowed less-than-anticipated to a level of $46.5 billion in May, after registering a deficit of $47.6 billion in the prior month.

Another set of economic data showed that the US ISM non-manufacturing PMI surprisingly rose to a level of 57.4 in June, while investors had envisaged for a drop to a level of 56.5. In the previous month, the PMI had registered a reading of 56.9. Additionally, the nation’s final Markit Markit services PMI unexpectedly advanced to a level of 54.2 in June, expanding at its fastest pace since January 2017 and compared to a reading of 53.6 in the previous month. The preliminary figures had recorded a drop to a level of 53.0. Moreover, the nation’s MBA mortgage applications rebounded 1.4% in the week ended 30 June 2017, following a decline of 6.2% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1414, with the EUR trading 0.06% lower against the USD from yesterday’s close.

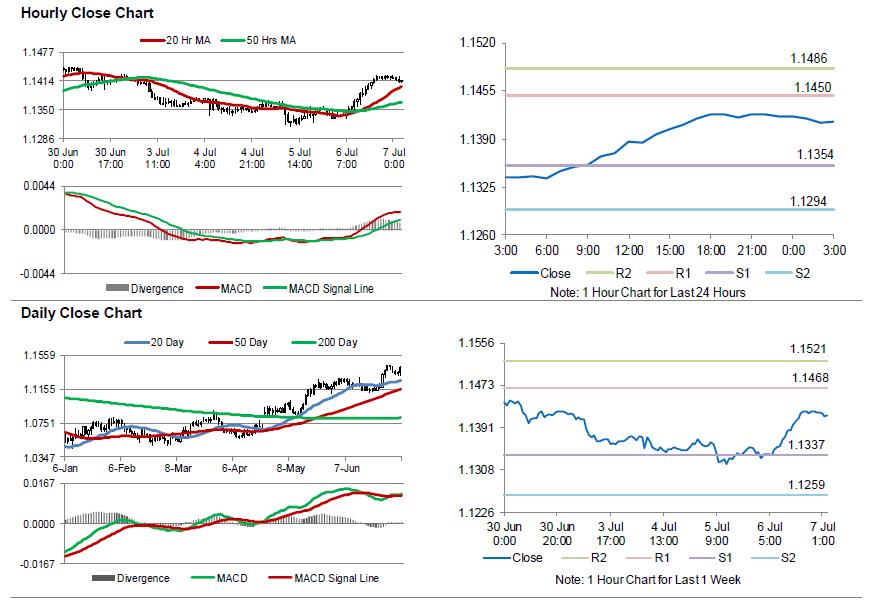

The pair is expected to find support at 1.1354, and a fall through could take it to the next support level of 1.1294. The pair is expected to find its first resistance at 1.145, and a rise through could take it to the next resistance level of 1.1486.

Going ahead, investors will focus on Germany’s industrial production data for May, slated to release in a few hours. Additionally, in the US, the crucial non-farm payrolls, unemployment rate and average hourly earnings data, all for June, slated to release later today, will attract significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.