For the 24 hours to 23:00 GMT, the EUR rose 0.72% against the USD and closed at 1.0668.

According to minutes of the European Central Bank’s (ECB) latest monetary policy meeting, board members saw “no room for complacency” as they argued that the recent pick-up in inflation had been mainly driven by an increase in energy prices and judged that fundamental picture remained largely unaltered. Policymakers, therefore, pledged to continue their support for the Euro-zone’s economy through the end of this year, as risks and uncertainties had not receded substantially.

The greenback weakened against most of its key peers, amid rising uncertainty over the timing of the Federal Reserve’s (Fed) next interest rate increase.

In economic news, initial jobless claims in the US rose less-than-anticipated to a level of 239.0K in the week ended 11 February 2017, compared to market expectations of a rise to a level of 245.0K and following a reading of 234.0K in the prior week. Additionally, the nation’s housing starts fell 2.6% MoM, to an annual rate of 1246.0K in January, while investors had envisaged for a fall to a level of 1226.0K and after registering a revised level of 1279.0K in the previous month. On the other hand, the nation’s building permits jumped to its highest level since November 2015, after it gained 4.6% on monthly basis, to an annual rate of 1285.0K in January, surpassing market anticipation for a rise to a level of 1230.0K and compared to a revised reading of 1228.0K in the prior month. Also, the nation’s Philadelphia Fed manufacturing index unexpectedly advanced to a level of 43.3 in February, accelerating to a 33-year high level, thus fuelling optimism over the health of the nation’s industrial sector. Investor consensus was for the index to drop to a level of 18.0, following a reading of 23.6 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0674, with the EUR trading 0.06% higher against the USD from yesterday’s close.

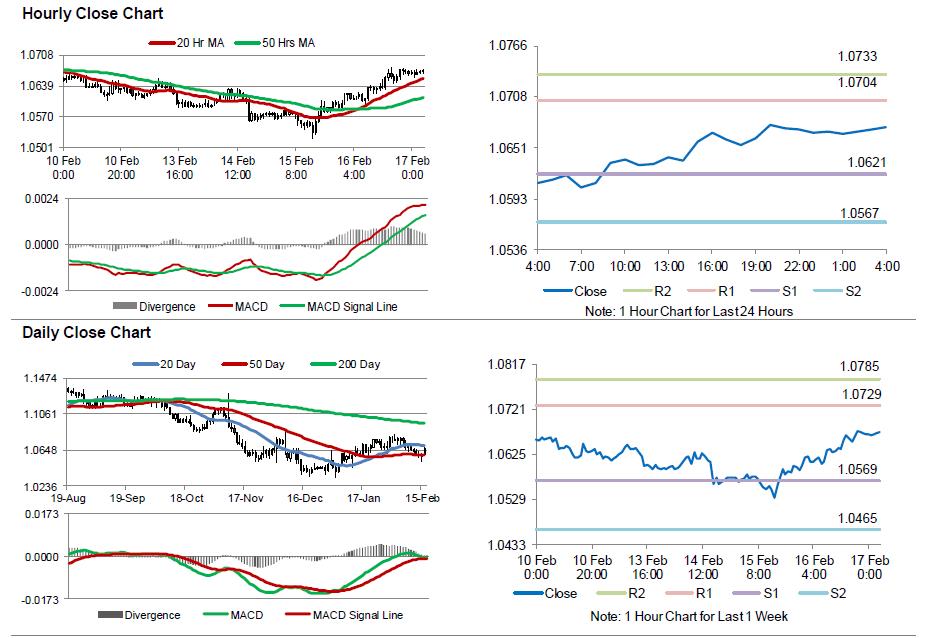

The pair is expected to find support at 1.0621, and a fall through could take it to the next support level of 1.0567. The pair is expected to find its first resistance at 1.0704, and a rise through could take it to the next resistance level of 1.0733.

Going ahead, traders would concentrate on the Euro-zone’s construction output and current account data, both for December, due to release in a few hours. Moreover, the US CB leading indicators data for January, slated to release later today, will be on investor’s radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.