For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.3807, benefited from a report that showed consumer confidence in the Euro-zone economy improved more-than-expected by 0.6 points (MoM) to -8.7 in April, from previous month’s negative reading of 9.3. Meanwhile, the Euro-zone’s construction output rose 6.7% (YoY) in February, slower compared to an 8.0% growth recorded in January. However, the Euro-zone’s common currency came under pressure after an ECB policymaker, Benoit Coeure hinted that the central bank still has “several instruments in the event that it is necessary to loosen monetary policy, ” including moving interest rates “into negative territory” and quantitative easing measures. Separately, another ECB member, Luis Linde indicated that the central bank would await Euro-zone’s inflation data for April and May before deciding on adding extra stimulus measures to the economy.

Meanwhile, in the US, former Fed Chairman, Ben Bernanke expressed an optimistic outlook on the growth of the US economy by stating that the nation “is making considerable progress” and that many of the headwinds from the 2008-09 financial crisis are beginning to dissipate.

The US Dollar gained ground for a brief period of time after the release of upbeat data from the US. The US house price index increased 0.6% on a seasonally adjusted monthly basis in February, higher than economists’ estimate for a 0.5% rise. Likewise, the Richmond Fed manufacturing index also rose more than forecast in April however, existing home sales in the US declined 0.2% to an annual rate of 4.59 million in March, the lowest level since July 2012.

In a noteworthy event, DBRS Inc. upgraded its outlook on the US’s “AAA” credit-ranking to “stable” from “negative” on the back of declining Federal budget deficits.

In the Asian session, at GMT0300, the pair is trading at 1.3816, with the EUR trading 0.07% higher from yesterday’s close.

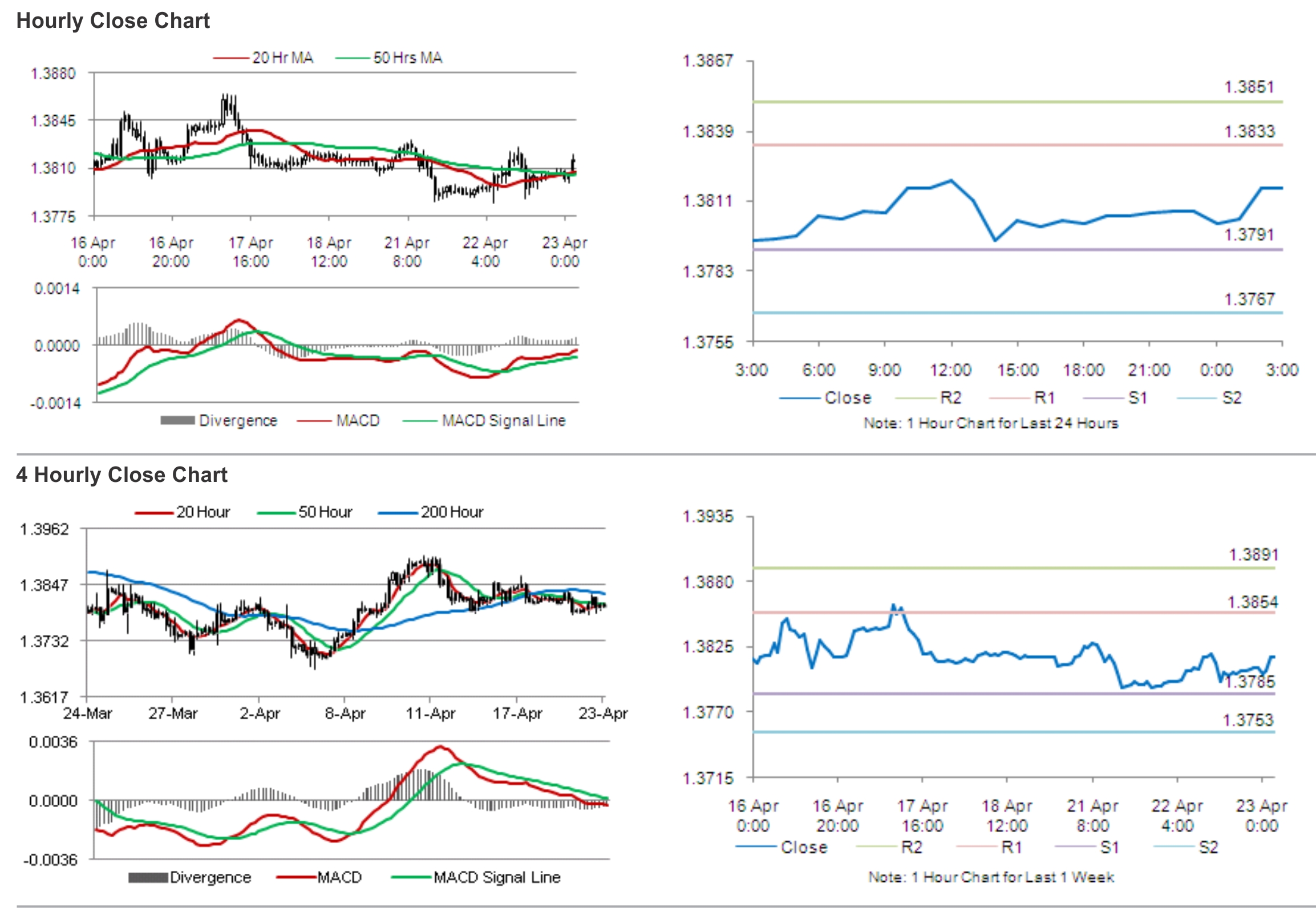

The pair is expected to find support at 1.3791, and a fall through could take it to the next support level of 1.3767. The pair is expected to find its first resistance at 1.3833, and a rise through could take it to the next resistance level of 1.3851.

Later today, traders would eye Markit manufacturing and service PMI data for the Euro-zone economy and its member nations, Germany and France, for further cues in the Euro.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.