For the 24 hours to 23:00 GMT, the EUR rose 0.42% against the USD and closed at 1.1732, after the US President, Donald Trump and the European Union President Jean-Claude Juncker agreed to work toward ‘zero tariff’ deal, thereby easing trade tensions.

Data showed that in Germany, Europe’s largest economy, the IFO business climate index fell slightly to a level of 101.7 in July, marking its lowest level since March 2017 and less than market expectations for a drop to a level of 101.5. In the prior month, the index had recorded a reading of 101.8. Moreover, the nation’s IFO business expectations index eased to a level of 98.2 in July, compared to a revised reading of 98.5 in the previous month. Markets had envisaged the index to decline to a level of 98.3.

On the other hand, the nation’s IFO current assessment index unexpectedly rose to a level of 105.3 in July, following a revised level of 105.2 in the previous month. Market participants had anticipated the index to drop to a level of 104.9.

In the US, new home sales unexpectedly dropped by 5.3% on monthly basis to a level of 631.0K in June, defying market expectations for a rise to a level of 668.0K. In the preceding month, new home sales had registered a revised reading of 666.0K. Moreover, the MBA mortgage applications slid 0.2% on a weekly basis in the week ended 20 July, following a decline of 2.5% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1736, with the EUR trading slightly higher against the USD from yesterday’s close.

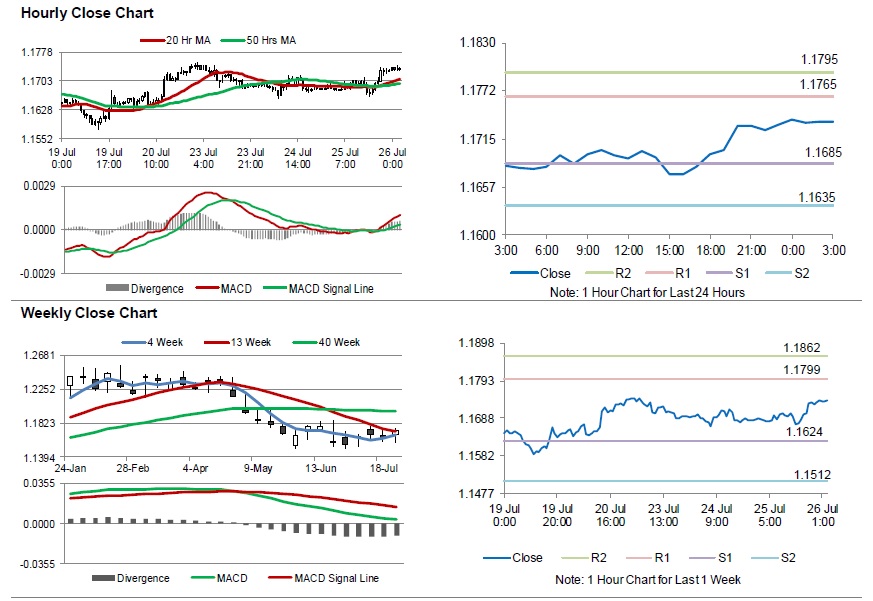

The pair is expected to find support at 1.1685, and a fall through could take it to the next support level of 1.1635. The pair is expected to find its first resistance at 1.1765, and a rise through could take it to the next resistance level of 1.1795.

Moving ahead, investors will keep an eye on the European Central Bank (ECB) interest rate decision followed by President, Mario Draghi’s speech, due later in the day. Additionally, Germany’s Gfk consumer confidence index for August, slated to release in a while, will be on investors radar. Later in the day, the US initial jobless claims followed by advance goods trade balance and durable goods orders, both for June, will keep traders on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.