For the 24 hours to 23:00 GMT, the EUR rose 0.19% against the USD and closed at 1.1371.

On the macro front, Germany’s Ifo business expectations index dropped to a level of 97.3 in December, more than market expectations for a fall to a level of 98.3. In the previous month, the index had recorded a level of 98.7. Moreover, the nation’s Ifo business confidence index eased to a level of 101.0 in December, hitting its lowest level in two years and compared to a level of 102.0 in the prior month. Market participants had expected the index to decline to a level of 101.7. Also, the Ifo current assessment index slid to a level of 104.7 in December, compared to market consensus for a fall to a level of 104.9. In the preceding month, the index had recorded a reading of 105.4.

The US dollar declined against a basket of currencies yesterday, amid caution ahead of the Federal Reserve’s monetary policy decision.

In the US, data showed that the US housing starts advanced 3.2% on monthly basis, to an annual rate of 1256.0K in November, amid rise in construction of multi-family homes. Housing starts had registered a revised reading of 1217.0K in the prior month. Moreover, the nation’s building permits unexpectedly rose to a seven-month high level by 5.0% on monthly basis, to an annual rate of 1328.0K in November. In the preceding month, building permits had recorded a revised level of 1265.0K.

In the Asian session, at GMT0400, the pair is trading at 1.1386, with the EUR trading 0.13% higher against the USD from yesterday’s close.

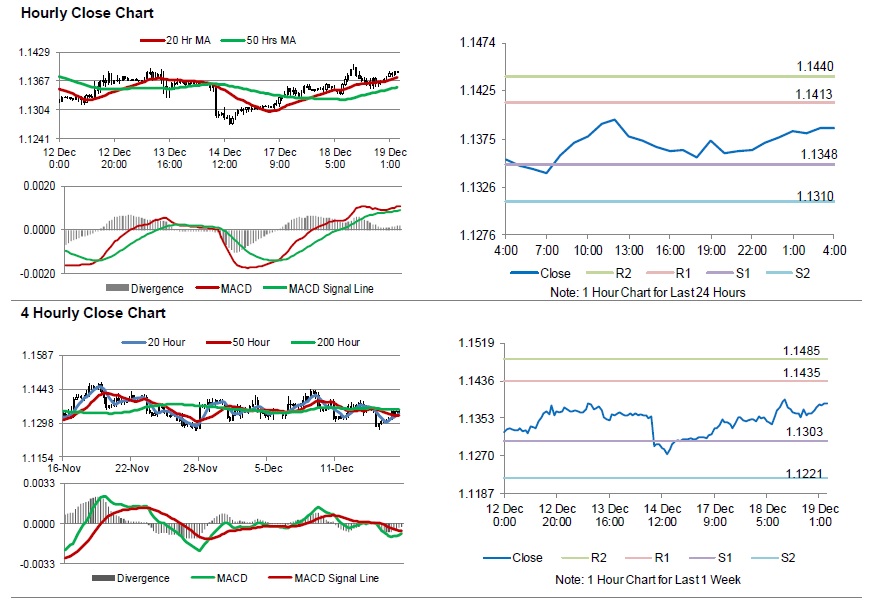

The pair is expected to find support at 1.1348, and a fall through could take it to the next support level of 1.1310. The pair is expected to find its first resistance at 1.1413, and a rise through could take it to the next resistance level of 1.1440.

Looking forward, traders would await the Euro-zone’s construction output for October followed by Germany’s producer price index for November, set to release in a few hours. Later in the day, the US Federal Reserve’s interest rate decision along with the US existing home sales for November, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.